After the shock waves of the COVID-19 outbreak blew away in China, summer just rolled around for another hot season of ice creams and sparkling drinks.

Even after a historical global public health crisis that has shattered the economy worldwide and regional labor markets, the Chinese consumption market still demonstrated a certain degree of resilience.

New brands are cropping up, while online and offline retail channels are permeated with fancy concepts such as “zero sugar”, “zero fat” promoted by bottled drink startup Genki Forest, or the “Hermes of ice cream”, referring to an ice cream startup Chicecrem, or Zhong Xuegao in Chinese.

Last week, KrASIA reported that Genki Forest was upon completing a new financing round that would raise its valuation to more than USD 2 billion. While Chicecream was the most sold ice cream brand in the “618” online sales event taking place in June on Tmall and Taobao, China’s biggest e-commerce duo.

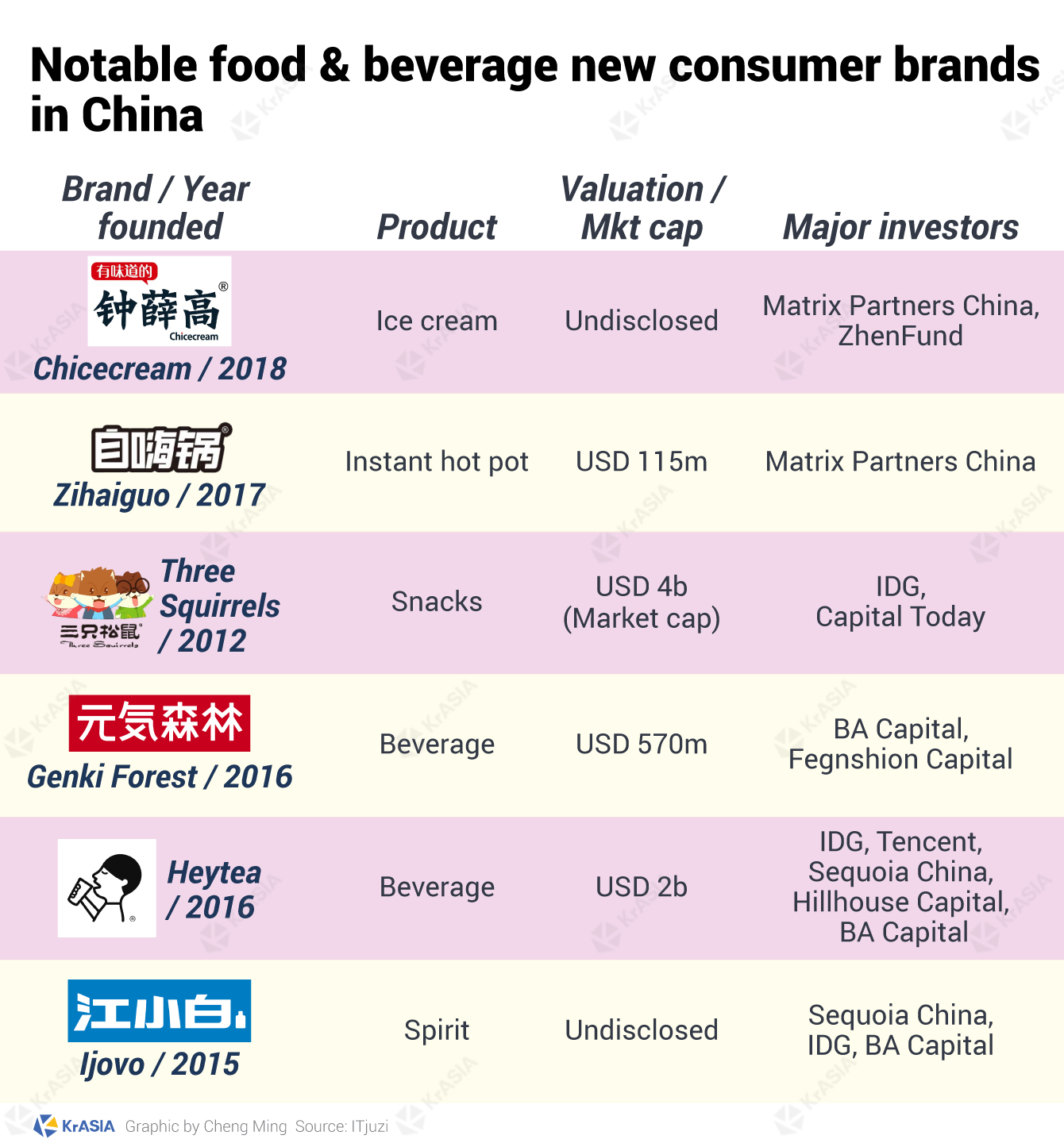

Founded in 2016 and 2018 respectively, these two brands have won mind share and support from investors. And they are just two of the new crop of like-minded food & beverage startups that have gained huge popularity among China’s rising young and well-established generation in a short time.

An expensive fashion

One thing in common for these new consumer brands is that they cost much more when compared with their mass-market peers. Chicecream, hinted by its nickname the “Hermes of ice creams”, costs around RMB 20 (USD 2.9) apiece, when at the same time, ice cream found in convenience stores across China averages at less than half of its price. In 2018, it even released an “Ecuadorean pink diamond” seasonal product that costs as much as RMB 66 (USD 9.4).

Still, Chicecream is well-received among affluent customers in China, with more than 8 million ice creams sold in 2019, or on average 22,000 a day. Considering it’s not even launched until May 2018, this is an encouraging sales performance.

Tencent-backed tea chain Heytea is another example. With its first store being set up eight years ago, it now operates 592 stores across the country as of July 23, 2020. China as a tea-sipping country is in no lack of tea chains over all these years, and Heytea’s offerings aren’t cheap. But that’s not discouraging the long queue—often seen as a sign for Heytea stores—outside its storefronts. Avid consumers reportedly would queue as long as 7 hours for a taste of its “cheese milk form oolong tea” when it opened the first Shanghai flagship store in 2017, reported by The Paper.

In addition to ice cream and tea, baijiu, or white spirit, the characteristic Chinese alcohol, is also being disrupted by venture capital-backed startups.

For instance, Ijovo, also known as Jiang Xiaobai in Chinese, which is reportedly preparing for a 2020 public listing, was estimated to have hit an RMB 3 billion (USD 430 million) revenue in 2019. Thanks to its packing and improved taste that targets the younger generation, it has gained popularity among Chinese youngsters, who are not the typical baijiu drinkers.

In the below graphics, we listed out some new brands that have been growing rampantly, some of them even made it to the unicorn status.

The internet mojo

On Genki Forest’s official website, there are pictures showcasing farmers plucking teas in plantations, a tagline above the pictures reads: “Established in 2016, Genki Forest is an internet + beverage company specialized in sugar-free and low-calorie products.”

While one might wonder what has internet to do with a bottled tea drink maker, it is through internet Genki Forest reached to consumers and swayed their reception.

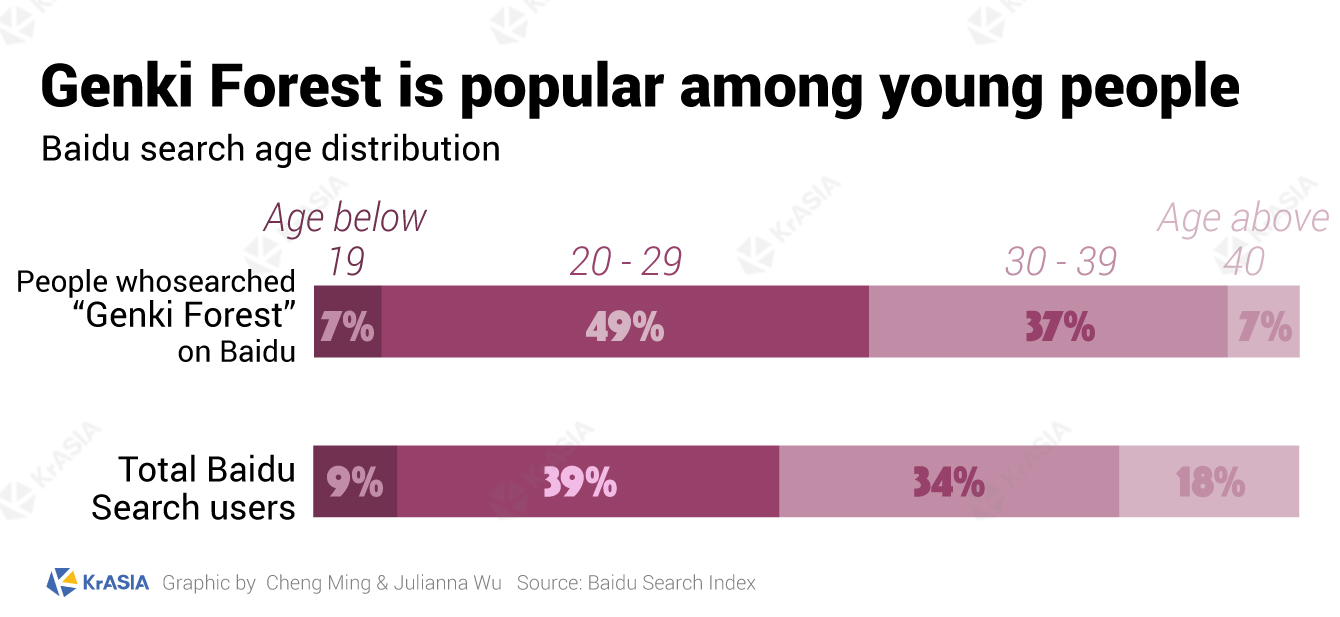

According to a recent report by Beijing Normal University, Chinese internet users aged 19-35, unlike their previous generations, see shopping more of an online social activity: they get to know products from bloggers, live-streamers or online ads; they rely on key opinion leaders’ reviews for new products hunting; and after purchasing, they would actively participate in discussion with friends and share their experience and opinions.

Genki Forest has established plenty of touchpoints across Chinese social media platforms: from short video app Douyin, to messaging app WeChat, Twitter-like microblog Weibo, and long video streaming service Bilibili. The company’s products can be seen promoted by young celebrities, and recommended by internet influencers.

A search “Genki Forest” on RED, the little red book, one of the most used product review apps in China yields more than 6,000 reviews, five times more than “Oriental Leaves”, one of its competitors in the zero-sugar beverage category.

Internet is not just helping promote these brands, it also sells them.

E-commerce platforms have accounted for a big portion of their products’ sales, especially when most of them don’t have too many physical distribution resources—some of which, boasting of their light asset model—even rely on third-party manufacturers for producing.

So all these new consumer brands have set up e-shops on mainstream local e-commerce platforms such as Taobao, Tmall, and JD.com, as well as on WeChat in the form of mini-programs. Some brands, like snack star Three Squirrels (SHE: 300783) and Chiicecream, didn’t even bother having their own offline stores until they gained internet reputation among young consumers.

As a result, consumers get to know them online and usually would be able to buy from referral links embedded in blog posts, live-streaming shows, or short video clips.

In Q1 2020, snack brand Bestore (SHA: 603719) completed more than half of its total sales through various online channels, as KrASIA reported, while for Three Squirrels, sales on JD.com, Taobao, and Tmall combined took up 80% of its total sales.

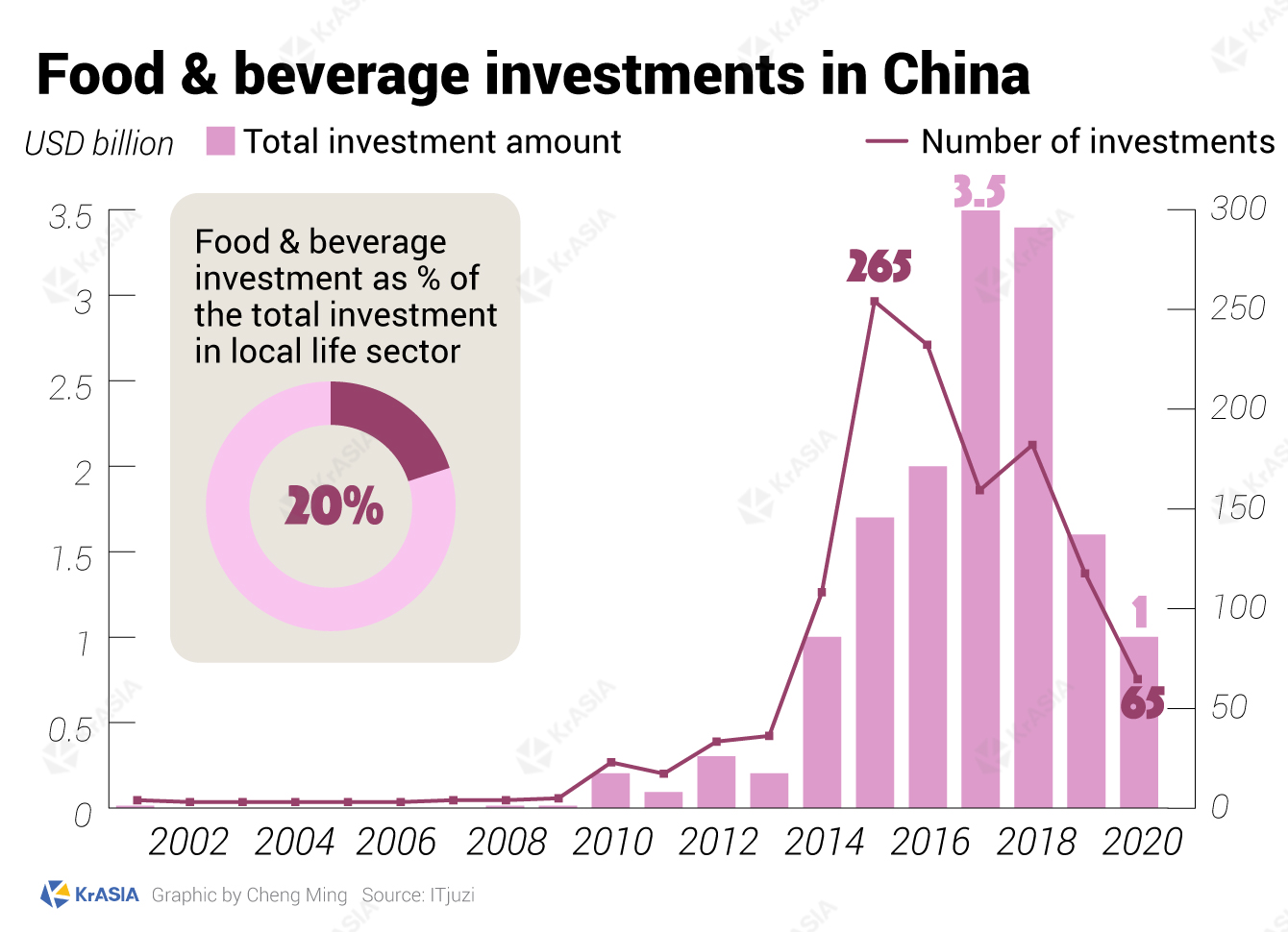

A window for investments

If successfully secured its latest round of fundraising,—said to be joined by big names including Sequoia China—Genki Forest’s valuation would soar 3.5 times in nine months from its B round in last October.

Different from other popular internet sectors like healthcare and AI, in which startups actively, if not desperately, looking for big money injections to save their widen net losses or support the costly R&D activities, “good ones” in the food & beverage industry “can turn a profit quickly” said an analysis piece published by 36Kr.

As a result, this sector doesn’t always raise a huge amount of money, but the payback is promising.

As of July 14, Chinese securities company Shenwan’s primary food and beverage sector index increased 46.35%, according to financial data service provider Wind.

More and more Chinese venture capitals started to look into the F&B sector, as well as restaurant chains. ByteDance-backed BA Capital, for example, is on the capital tables of Heytea, Genki Forest, and Ijovo. Well-rounded VCs like IDG, Sequoia China, and Hillhouse Capital are also frequently seen pouring money into the leaders of niche consumer brands.

“If you compare it to the US, you will find that there are fewer consumer brands of the same size and scale (as their U.S. counterparts) in China,” Loyal Valley Capital’s partner Ye Chunyan told 36Kr in an interview: “In the future, there will be a group of ten-billion-dollar consumer companies in China.”

While investors like Ye expect to incubate China’s very own food & beverage giant like Coca-Cola, there are also reasonable suspicions over whether the combination of venture-backed fast expansion, reliance on the internet and third-party factories would just breed the next Luckin Coffee.