Meituan Dianping (Meituan, HKEX: 3690) now runs an on-demand delivery empire of 6.2 million registered merchants and 3.99 million active riders in China, the company announced Tuesday.

With Tencent (HKG: 0700) as one of its backers, Meituan is able to access to the massive user bases of WeChat and QQ, China’s two most popular messaging and social media platforms, while rival Ele.me channels users from Alibaba (NYSE: BABA) ‘s apps like e-commerce marketplace Taobao and mobile wallet Alipay.

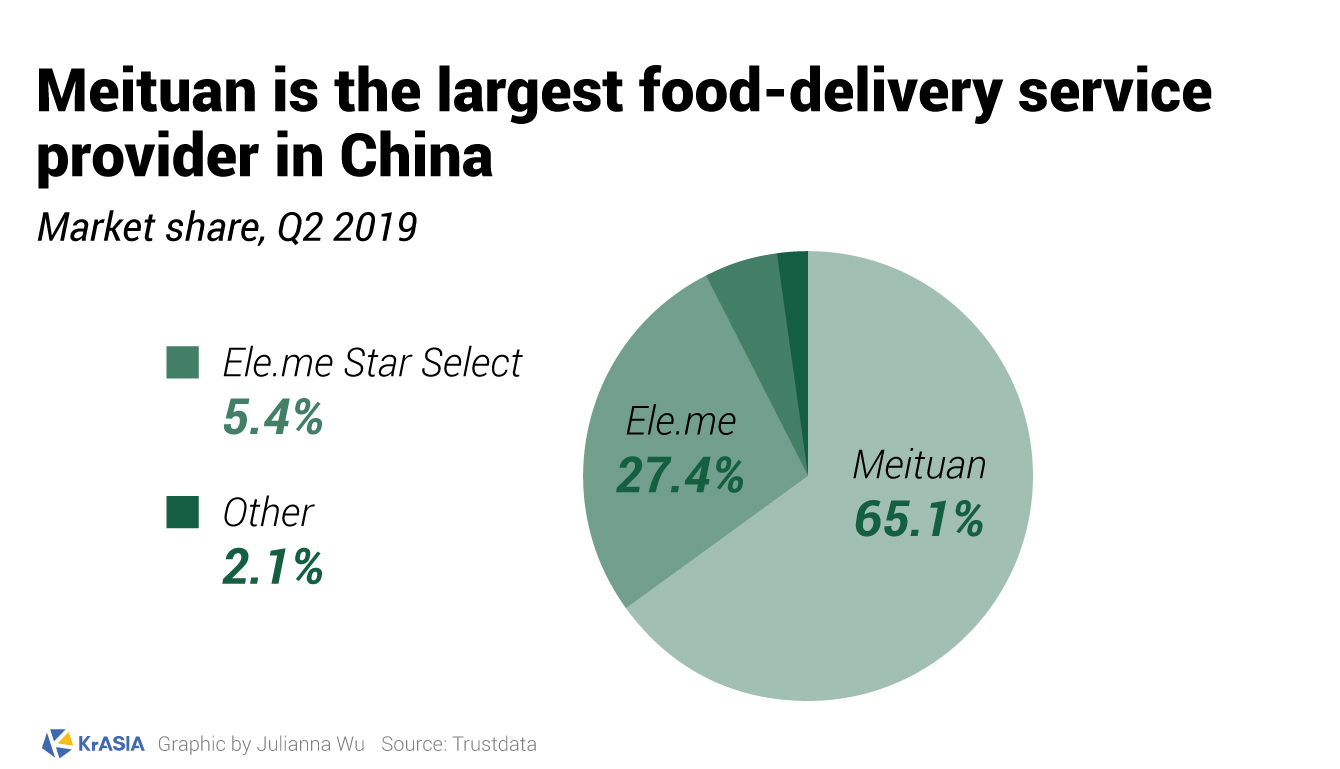

Currently controlling 65% of the food delivery market, Meituan continues to expand its ambitions to other local life services. The Beijing-based company is aggressively entering into the power bank sharing market which is valued at USD 1.12 billion, as KrASIA reported earlier.

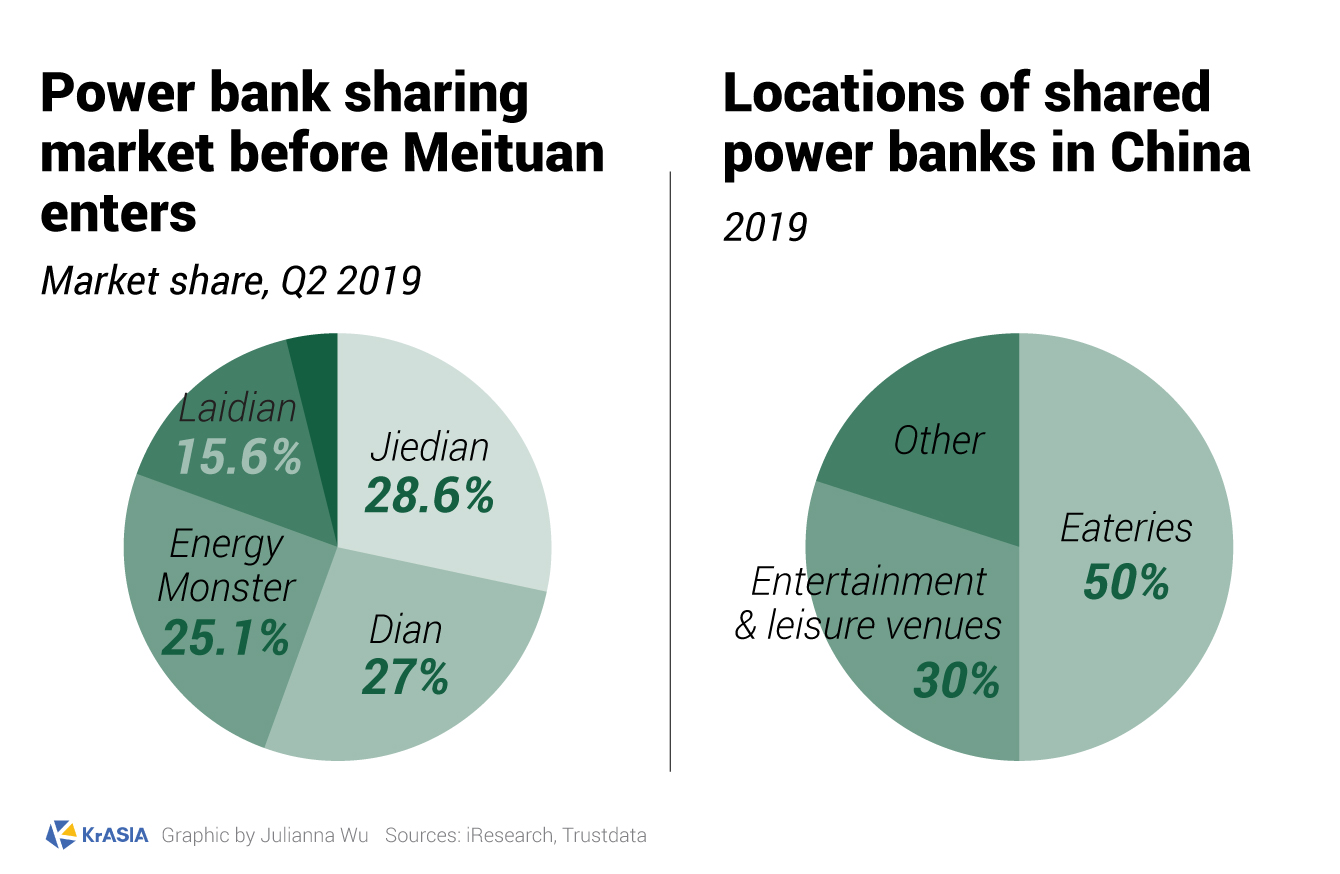

Meituan is recruiting local agents in more than 100 cities in China to help deploy its power bank rentals to restaurants, shopping malls, and other offline merchants. The company entices business owners by promising more reviews on its rating site if they sign the power bank contract, said 36Kr.

Meituan is recruiting local agents in more than 100 cities in China to help deploy its power bank rentals to restaurants, shopping malls, and other offline merchants. The company entices business owners by promising more reviews on its rating site if they sign the power bank contract, said 36Kr.

China had its power bank startup boom in 2017, at the peak of which an estimated RMB 1.2 billion (USD 170 million) from 35 venture capital firms was poured into the market in less than 40 days.

Back then, Meituan pulled out its power bank sharing too but soon quit. Now, it’s reigniting the play at a time when food-delivery has become an important source of revenue for many eateries as the COVID-19 outbreak decimated offline traffic, making it difficult for merchants to deny increased exposure on the platform.

Meituan’s move would certainly reshuffle leadership in the niche sector, which settles in 2019 with four major players each accounted for roughly a quarter of the market.

After merging with business review and rating app Dianping in 2015 and acquiring bike-sharing startup Mobike in 2018, Meituan now offers a variety of local life services on its app, ranging from on-demand delivery, local business ratings, ride-hailing, and even hotel and airplane ticket booking.

Meituan Dianping’s market cap is HKD 747.6 billion (USD 96.4 billion) as of May 20, 2020, only behind Tencent and Alibaba among China’s internet giants.