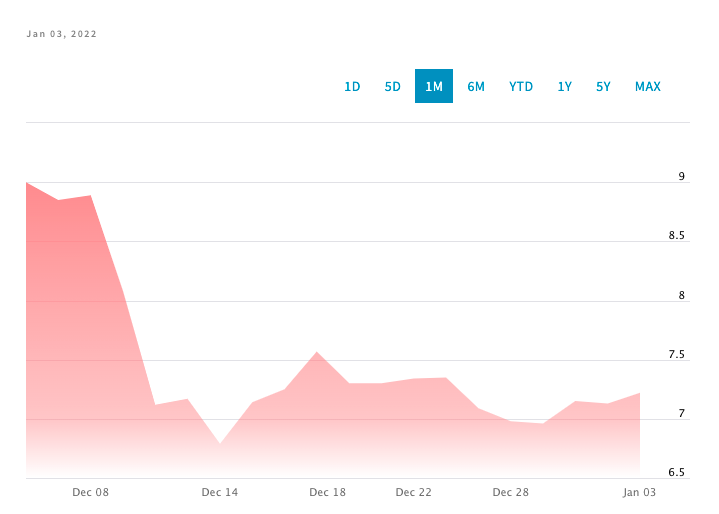

It’s been more than a month since Southeast Asian super app developer Grab gained its ticker on the Nasdaq via a SPAC merger with Altimeter Growth Corp. With a valuation of nearly USD 40 billion, Grab made history as the largest public debut in the US by a company based in Southeast Asia. But the firm had a bumpy start as its share price plunged more than 20% on its first day of trading, from USD 13.06 to USD 8.75.

Grab’s share price continued to tank over the next few weeks, reaching USD 6.79 at its lowest point on December 14. This week, on January 3, it closed at USD 7.22 with a market cap of roughly USD 27 billion—a significant shortfall from the valuation that made headlines in early December 2021. There are a few factors that determine a stock’s price, including the company’s financial performance, market conditions, liquidity, and business competition, according to Masana Takahashi, founder of Singapore-based accounting and corporate finance advisory firm Jidobox.

“Grab is only operating in Southeast Asia, so appetite for a newcomer from the region may not be welcomed so much by US investors. The US market is much bigger than Southeast Asia, and Nasdaq’s market cap is far larger than Singapore and Indonesia’s stock exchanges, meaning investors are bullish about Nasdaq and American companies but bearish on Southeast Asian firms,” Takahashi told KrASIA.

Grab’s stock performance in the first month does not offer any indication of the company’s future. Take Singapore-based Sea Group as a reference. Its stock price was flat for more than two years after its debut in 2017 but climbed nearly 400% in 2020. Sea’s e-commerce business Shopee and gaming arm Garena had significant growth throughout that year, driven by the pandemic. That growth shaped investor sentiment and contributed to the rise of Sea’s stock price.

Garena’s Free Fire was among the most downloaded games of 2021. Shopee is the top e-commerce platform in Southeast Asia and Taiwan, and it has plans for broader global expansion. In September 2021, Sea Group’s market capitalization was USD 181.9 billion, making it Southeast Asia’s most valuable public company.

However, Takahashi said that Sea Group had stronger financial fundamentals than Grab ahead of their respective IPOs. “Sea Group’s revenue in 2016 [financial year-end before its IPO] was USD 346 million, with a loss of USD 222 million. Meanwhile, Grab’s 2020 revenue was USD 469 million with a net loss of about USD 2.7 billion,” he said. Achieving profitability is a key challenge for Grab. Takahashi felt that the company’s IPO price was too high, making it less attractive than Sea Group in 2017.

Gabriel Li, an associate at Singapore law firm Withers KhattarWong, offered a slightly different view. He placed significant weight on market conditions as the driving force behind the dip. “The main factor here is probably rising interest rates set by the US central bank. When interest rates go up, stocks of companies that are trying to establish a path to profitability are worst hit because they may not have positive earnings and consistently positive cash flows,” Li told KrASIA.

The quick spread of the Omicron coronavirus variant is also creating uncertainty. In its 2021 Q3 financial report, Grab cited strict lockdowns in Vietnam as the main reason behind a decline in mobility revenues. “With no clear evidence of the severity of the new variant and no uniform way to govern or manage the virus, varying regulatory responses may end up adding a layer of uncertainty that may have been priced in as well,” Li said.

Li remains bullish about investors’ views toward Southeast Asia, as the region holds great potential to become one of the biggest consumer markets in the world over the next decade. “I think investor sentiment would still be strong, given that many are still looking for an alternative investment destination beyond China. Significant and oftentimes far-reaching regulatory responses in China may have caused many to reconsider their investment strategies,” he said.

Southeast Asia is on the cusp of a game-changing digital transformation. Grab’s ride-hailing, food delivery, and financial services make it one of the leading consumer tech companies in the region. After Grab, other tech companies like GoTo and Carousell are eyeing IPOs in the US. PropertyGuru is progressing towards a listing on the New York Stock Exchange in the first quarter of 2022. Nevertheless, Li said that Southeast Asian companies with those plans might have to consider less aggressive valuations and take into account interest rate hikes before they commit to becoming public companies.