Based on sales volume, the Hongguang MINIEV manufactured by SAIC-GM-Wuling Automobile (SGMW) is the “champion” of the EV market in China. According to the latest global rankings for green energy vehicles published by CleanTechnica, the Hongguang MINIEV had the second highest global EV sales in November 2021, with a sales volume of 40,400 vehicles. These sales accounted for 5.6% of the global market share in that month, second only to Tesla’s Model Y.

According to the data from January to November 2021, a total of 368,400 Hongguang MINIEVs were sold, again making the model the second most popular EV in the world, accounting for 6.61% of the global market share in terms of total sales volume.

The Hongguang MINIEV’s low price is largely attributed to its high sales volume. The price of the Hongguang MINIEV with a basic configuration is RMB 28,800 (USD 4,300), and the price of the flagship model is RMB 38,800 (USD 5,800). Chinese and Japanese media have analyzed the cost of the Wuling Hongguang and found that the profit from selling a single Hongguang MINIEV is just RMB 89 (USD 13.30).

With such a low profit margin, why does SGMW continue to sell this vehicle? The truth is that SGMW is benefiting from corporate average fuel consumption (CAFC) and new energy vehicle policy, which together form a part of China’s carbon neutrality strategy, whereby the Hongguang MINIEV brings in greater profits in addition to sales. This model is of great strategic significance to the company.

In this report, we will explain China’s dual credit system and its impact on automobile manufacturers.

What is the dual credit system?

The dual credit system was originally a phased system that was introduced during the evolution of laws and regulations on controlling fuel consumption in China. We can see from the timeline below that the dual credit system was announced in September 2017 and implemented in April 2018. China implemented the dual credit system for two reasons. First, there was a need to improve the efficiency of fuel utilization and reduce fuel consumption. Then, the government aimed to promote the rapid development of green energy vehicles, achieve technological breakthroughs, and cultivate domestic industries.

Here are the relevant developments that led to the dual credit system:

- 2001: Began research on fuel consumption standards and policies.

- 2004: The national standard of “Limits of Fuel Consumption for Passenger Cars” (GB 19578-2004) was released in September (and implemented in July 2005). It regulates the fuel consumption of single vehicles based on their gross weight. This regulation was updated twice, first in 2014 and again in 2021, with GB 19578-2021 as the latest version.

- 2011: The average fuel consumption of enterprises (the concept of “CAFC credits”) was specified in GB 27999-2011 and announced in December 2011 (then implemented in January 2012). This regulation was updated twice, first in 2014 and again in 2019, with GB 27999-2019 as the latest version.

- 2012: “The Development Plan for Energy-saving Vehicles and New Energy Vehicles” (2012–2020) was issued in June, specifying that the average target fuel consumption of passenger vehicles should be 5L/100km in 2020.

- 2017: In September, the Ministry of Industry and Information Technology, the Ministry of Finance, the Ministry of Commerce, the General Administration of Customs, and the General Administration of Quality Supervision, Inspection, and Quarantine (AQSIQ) of China jointly released the 2017 “Administrative Methods for Corporate Average Fuel Consumption and New Energy Vehicle Scores for Passenger Vehicle Manufacturers,” hereinafter referred to as the Administrative Methods for Dual Credits (it took effect on April 1, 2018). This introduced the concept of “NEV credits” for the first time.

“Dual credit” refers to two measures: CAFC credits (corporate average fuel consumption) and NEV credits (new energy vehicles).

How does the dual credit system guide automobile manufacturers to reduce the fuel consumption of traditional vehicles while producing as many green energy vehicles as possible? To answer that question, we must study the calculations and application of the dual credit system.

CAFC credit score calculation method

A CAFC credit score is a product of the difference between the “standard value” and “actual value” of the fuel consumption of all vehicles manufactured in or imported into China, and the production or import volume. This is the formula:

CAFC credit score = (standard value − actual value) × production or import volume

As for the “standard value,” we can regard it as the desired fuel consumption allowed by the Chinese government:

Standard value = target corporate average fuel consumption × proportion of standard requirements *

* The proportion is specified in the policy

The “actual value” refers to the weighted average of fuel consumption of all vehicle models that the manufacturer manufactures or imports:

Actual value = ∑ (single vehicle consumption × single vehicle output) / ∑ (single vehicle output × vehicle model multiplier discount)

If the manufactured and imported volumes of fuel-consumption vehicles of two manufacturers are the same, then the manufacturer with a higher output of green energy vehicles will obtain a higher CAFC credit score.

Meanwhile, if the output and import volumes of green energy vehicles of two manufacturers are the same, then the manufacturer with a higher output of fuel-consumption vehicles and higher overall fuel consumption will obtain a lower CAFC credit score.

NEV credit score calculation method

According to the provisions of the Administrative Methods for Dual Credit, the “NEV credit score” of passenger vehicle manufacturers is the difference between the actual value and standard value of its green energy vehicle credit score.

This means that:

NEV credit score = actual value of green energy vehicle credits − standard value of green energy vehicle credits

The actual value of a green energy vehicle credit score refers to the sum of products of the credit score of each green energy vehicle model and the output of that model.

The standard value of a green energy credit score is the total amount of traditional energy vehicles manufactured or imported multiplied by the required credit proportion of green energy vehicles (this proportion is specified in the policy).

According to the provisions of the Administrative Methods for Dual Credit, the proportion of green energy vehicle credits must be 10% (2019), 12% (2020), 14% (2021), 16% (2022), or 18% (2023) of the total amount of traditional energy vehicles manufactured or imported. For example, in 2020, the Ministry of Industry and Information Technology of China specified that the proportion of green energy vehicle credits in that year was 12%. If one manufacturer produced 1 million traditional energy passenger vehicles, then the standard value would be 120,000.

Dual credit penalty system

For each automobile manufacturer, CAFC and NEV credit scores are calculated separately. This means that every automobile manufacturer will have its own CAFC and NEV credit scores calculated annually. There is no proportional conversion relationship between CAFC and NEV credit scores, but they can be added together. For example, if a manufacturer in 2020 has –10,000 CAFC credits, but 12,000 NEV credits, then the manufacturer’s total credit score for 2020 will be 2,000.

CAFC and NEV credit scores are added on an annual basis, and the result must be positive. If an automobile manufacturer’s credit score is still negative within 90 days after releasing its accounting report, it will be severely punished. Before a manufacturer’s CAFC and NEV credit scores return to zero, their fuel-consuming products that do not meet the standard cannot be listed in the product catalog of the Ministry of Industry and Information Technology, and are thus prohibited from being sold.

If an automobile manufacturer with a negative credit score wants to avoid punishment, it can proceed in one of two ways. The first is in-house treatment. It can obtain positive CAFC credits from affiliated enterprises in its group, or use the balance of credits earned from previous years. Another method is to obtain credits from other enterprises that sell NEV credits to offset its deficit. All automobile manufacturers strive to reduce the energy consumption of traditional energy vehicles, develop green energy vehicles, and improve their credit scores.

Transactions, compensation, and the dual credit carry-over system

In the dual credit design system, the transaction and compensation of positive and negative credit scores are designed differently. CAFC positive credits cannot be traded, and can only be transferred between affiliated enterprises.

For example, the fuel-consumption credits of different brands in the same automobile group can be transferred among each other, which means that the positive credits of SGMW can be transferred to SAIC GM.

A negative CAFC credit score can be offset with a positive CAFC credit score or NEV credit score.

A negative NEV credit score can only be offset with a positive NEV credit score.

A positive NEV credit score is the only score that can be traded freely in the dual credit system. It can be traded between different automobile manufacturer groups, and the price fluctuates.

In addition, according to the regulations of the Ministry of Industry and Information Technology, a certain proportion of positive CAFC credits can be settled and accounted for in the next financial year but will become void after three years. Positive credits in 2018 and previous years were carried forward at a proportion of 80%. Positive credits from 2019 and later were carried forward at a proportion of 90%. Due to the three-year carry-forward validity period, the positive credits from before 2018 expired in 2021. Positive NEV credits in 2019 could be carried forward in full for one year; positive NEV credits in 2020 were carried forward at a proportion of 50%.

For green energy positive credits generated in 2021 and later, enterprises can carry them forward at a proportion of 50%, as long as they meet one of the following conditions: (1) The ratio of the actual value of average fuel consumption of passenger vehicle manufacturers (only fuel passenger vehicles accounted for) to the standard value in this year cannot be higher than 123%; (2) The passenger vehicle manufacturer can only produce or import green energy vehicles. The carry-forward period for positive green energy credits cannot exceed three years. With this design, green energy automobile manufacturers have great advantages over their counterparts.

The impact of the dual credit system on automobile manufacturers

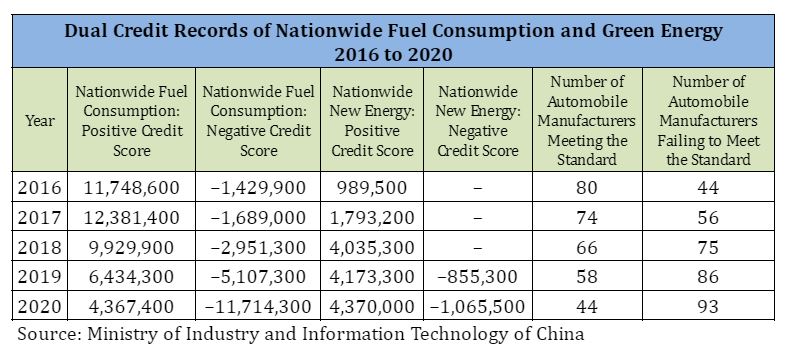

Since 2017, the Ministry of Industry and Information Technology of China has been releasing annual dual credit reports, outlining which enterprises satisfy or fail to meet the dual credit standards.

We can see that the positive CAFC credit score decreases year by year, and the negative credit score increases yearly, including a significant increase in 2020. The growth rate of the positive NEV credit scores decreased from 2018 to 2020. At the same time, 2019 and 2020 saw the lowest proportion of green energy vehicle output, resulting in a negative NEV credit score. The automobile manufacturers that met the official standards have reduced by half within five years, while the automobile manufacturers failing to hit the official mark have doubled.

From 2016 to 2019, after the positive and negative CAFC credits were offset, the balance became positive. Theoretically, the negative score can be offset by mutually transferring CAFC credits between affiliated enterprises. This means that there is no negative credit score, so new vehicles can be listed in the catalog of the Ministry of Industry and Information Technology, which affects listings and sales. In previous years, automobile manufacturers were not pressured by the dual credit system, since there were plenty of positive credits. The dual credit trading market was not flourishing, and the price of credits stayed below RMB 1,000 for a long time, without a high trading volume.

However, in 2020, the situation suddenly changed. After the offset of positive and negative CAFC credits, the gap was 7,346,900, and the balance of NEV credits was 3,304,500. The credit market was in short supply. The higher amount of negative CAFC credits in 2020 was mainly caused by the tightening standards of average energy consumption management. At the same time, after the pandemic relief in the second half of 2020, the automobile market rapidly recovered, focusing on SUV and medium- to high-end vehicle markets with high fuel consumption, resulting in higher average fuel consumption.

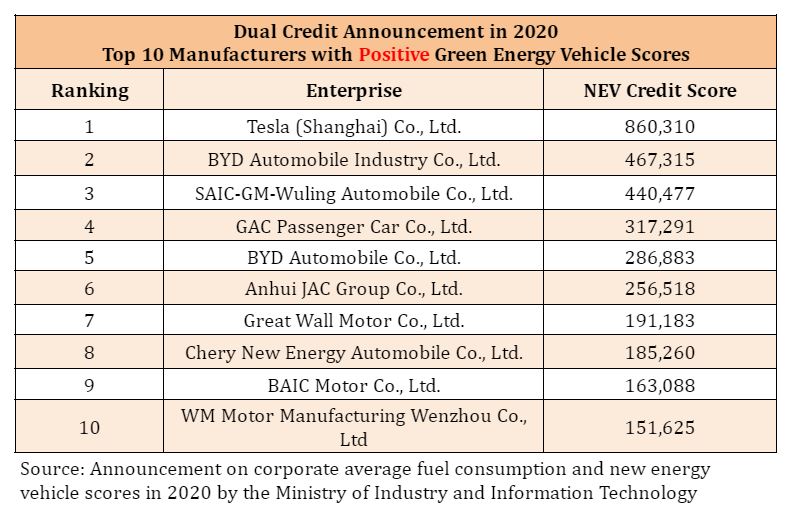

For each manufacturer, the difference between positive and negative NEV credits became more obvious in 2020. As reported by the Ministry of Industry and Information Technology of China, Tesla was the manufacturer with the highest positive NEV credit score, with over 860,000 NEV credits in 2020. BYD and SGMW ranked second and third in terms of positive NEV credit scores, respectively.

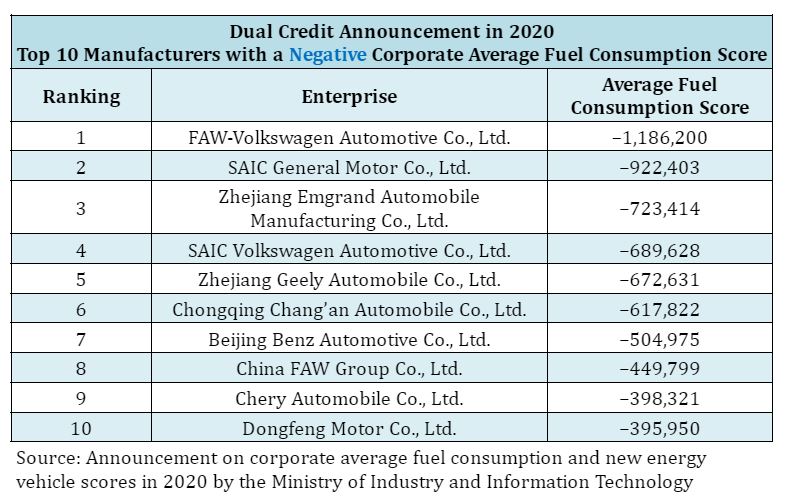

Judging from the credit scores in 2020, it is clear that the main automobile manufacturers with large production and sales volumes must reduce fuel consumption and offset negative CAFC credit scores. For example, FAW Volkswagen and SAIC GM had CAFC credit scores of –1,186,200 and –922,403, respectively, in 2020. Zhu Huarong, chairman of Chang’an Automobile, shared that six key Chinese automobile groups had negative credit scores in 2020.

It is costly for manufacturers to offset these scores. For example, in order to offset the dual credit score, profit for a single vehicle made by Chang’an group was reduced by RMB 4,000 in 2020. That year, Chang’an Automobile sold 2,003,700 vehicles and suffered a loss of RMB 6.011 billion due to the dual credit system.

From July 1, 2021, the national standard of the Passenger Vehicle Fuel Consumption Limit was implemented. In addition, the New European Driving Cycle (NEDC) was replaced by the Worldwide Harmonized Light Vehicles Test Cycle (WLTC) as the comprehensive fuel consumption test standard, which meant that the average fuel consumption threshold of traditional vehicles increased. With a more stringent standard in place, manufacturers will face higher pressure to reduce the consumption of fuel-burning vehicles.

While traditional vehicle manufacturers earmark significant funds to purchase credits, many green energy vehicle manufacturers gain revenue by selling their excess credits. According to a financial report released by EV maker Nio, in Q3 2021, the company earned RMB 517 million by selling NEV credits from 2020, which accounted for 5.27% of its total revenue from Q1 to Q3.

The Wuling Hongguang MINIEV gave its manufacturer an edge because it was able to sell credits, while many manufacturers are under pressure to seek new development directions.

Even though SGMW is a major automobile manufacturer, its vehicles have a very low profit margin. It may be counterintuitive to continue producing its MINIEV model.

However, according to Zhu Jun, deputy director of SAIC Technology, the original goal of SGMW for launching the MINIEV was to meet the policy requirements of the dual credit system. “Credit scores guide the development of the MINIEV. Small vehicles contribute the same number of credits as large ones. Due to the dual credit system, SGMW has a large sales volume and thus greater pressure is mounted on the company. However, the Hongguang MINIEV helps the enterprise meet its credit score requirements under the existing policy system. Otherwise, the company would have to buy more credits,” Zhu Jun explained.

In 2019, the CAFC credit score of SGMW was –184,868 and its NEV credit score was 101,759, with a gap of more than 80,000 credits. It was a typical case of a manufacturer failing to meet the dual credit standard. In late July 2020, SGMW launched the first four-seat Hongguang MINIEV, which has topped the sales list of Chinese green energy vehicles repeatedly since mass production began in August 2020. Data shows that 127,600 Hongguang MINIEVs were sold in 2020. That year, SGMW produced 932,700 passenger vehicles, including 178,300 green energy passenger vehicles. The company’s CAFC credit score increased to 494,334 and its NEV credit score to 443,141.

Since the Hongguang MINIEV has a low price, there are questions about its profitability. However, from the perspective of credits, thanks to this model, SGMW has not needed to buy any NEV credits from other car manufacturers. According to a research report about the dual credit system released by China Industrial Securities in May 2021, the trading price of NEV credits has increased from the initial price of RMB 300–500 per credit to RMB 2,500–3,000 per credit, an increase of nearly 1,000%. If calculated at RMB 3,000 per credit, SGMW would have earned RMB 1.329 billion through credit sales in 2020, equivalent to a profit of RMB 10,415 per vehicle. Although the profit from selling a single vehicle is less than RMB 100, the credit income arising from each sale gives the Hongguang MINIEV great strategic significance.

Thanks to the SGMW Hongguang MINIEV and its positive credit income, other automobile manufacturers have come under great pressure to increase their credit reserves.

In 2020, Volkswagen China and JAC Motors (ranked sixth in terms of NEV credits) announced that Volkswagen would invest EUR 1 billion to acquire a 50% stake in JAC’s parent company. This increased Volkswagen’s total holdings of JAC (Volkswagen’s EV joint venture) to 75%, which gave it the management rights for the joint venture. SAIC Volkswagen and FAW Volkswagen mostly sell traditional vehicles in the Chinese market, and had the highest and fourth highest negative CAFC credit scores in 2020, respectively. Volkswagen devotes significant spending to buying NEV credits. Volkswagen urgently needed to improve its production and sales of green energy vehicles in China. Therefore, the goal of its investment in JAC was to obtain more NEV credits. Previously, as specified in the JAC Volkswagen joint venture agreement, it emphasized that Volkswagen has priority over the surplus credits in the joint venture.

A Japanese language version of this report is available on connec2.jp, an information portal powered by 36Kr Japan. To inquire about research conducted by 36Kr Global, please contact 36Kr Global research lead Alex Zhao at [email protected].