In the past three months, Tencent was on a shopping spree, making six investments in retail and its investees include brick-and-mortar chain stores, menswear brand and e-commerce website.

Many would wonder why does a social networking and game major bet on retail, and also what is Pony Ma, Tencent founder and CEO, going to do with these new and diverse partners?

In this piece, we break down Tencent’s recent investment frenzy for you.

This is the Part 1 of a 2 Part-Series. Link to the Part 2.

Tencent participated in a number of investment deals in the retail sector between the end of 2017 and the 2018 Lunar New Year. The series of moves have come to be seen as one of the most important steps in the new retail scene ever since the concept was proposed two years ago.

The fact that the giant’s involvement is in many ways against the norm has further complicated the matter. Making sense of its recent moves in the sector thus becomes the key to gaining insights into the direction China’s retail industry is heading in 2018 and beyond.

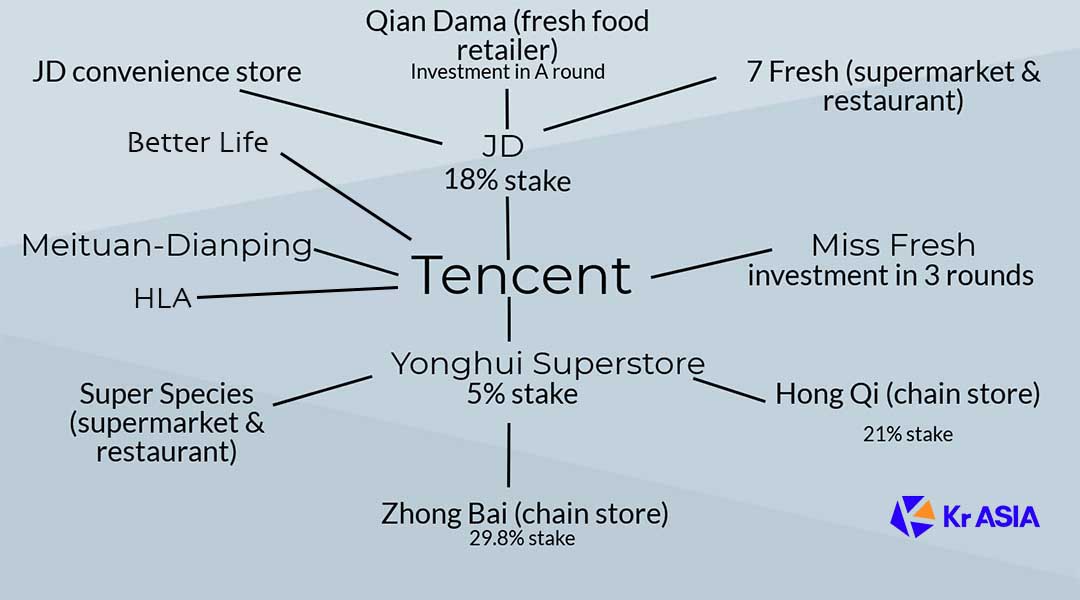

The binge started with Tencent’s buying into the supermarket chain Yonghui Superstores on December 12, 2017, which, as of February 8, 2018, or over a period of fewer than three months, has been followed by a host of similar deals, including investments in the special offers-focused e-commerce site Vip.com, Carrefour, Dalian Wanda Commercial Properties, the men’s wear retail brand HLA, and Better Life Commercial Chain Store. Plus, the tech mogul is recently in high-profile talks with China Resources Group, whose assets include the supermarket chain China Resources Vanguard, over a potential investment deal.

Read more: Tencent, JD Invests in Wanda’s Shopping Malls for $5.4B, A Second-time Charm?

What Tencent did in the past three months has amounted to a record-breaking investment frenzy in the world’s retail history both in terms of the speed at which deals are reached and the combined size of the companies invested.

So it has people wondering: Why on earth would a company whose business is built mainly on games, social networking services, and entertainment invest so extensively in retail?

Adding to the mysteriousness of all this is the fact that Tencent was in such a rush, targeted such a wide diversity of companies, and invested so little in each, as well as the ubiquitous role of Yonghui Superstores in those deals.

Tencent has yet to spell out its intention, but let’s just try to break things down with the information we already have.

First, let’s take a look at the questions worth our attention:

1. Why the rush?

This is the most asked question concerning Tencent’s latest investment frenzy. It seems that it was so afraid to miss the new retail race that it wanted to have a share in all of the leading retail chains in the country.

Indeed, Yonghui, Superstores Carrefour, Better Life, HLA and Wanda Commercial are all leading retail players in their respective sub-markets. And China Resources Vanguard, which Tencent may well invest in too, is owned by China’s largest real estate, FMCG and retail-focused state-owned enterprise by the number of brick-and-mortar stores.

Read more: Tencent Invests in Carrefour China to up Competition with Alibaba on New Retail

2. Why was Tencent so “stingy” with its investments?

Tencent became the second largest shareholder in JD Group in 2014 and holds a 15% stake in Yonghui Superstores, but accounted for only 5% of most of the other companies it invested in.

That means Tencent has limited say in their operation and management. Although a 5% stake entails different amounts of investment as companies’ valuations vary, it’s safe to say that Tencent has no intention of gaining any significant control of those businesses.

3. Why did Tencent target such a wide variety of companies?

What Tencent sees in Yonghui Superstores may be its status as China’s leading offline retail brand, but its investment in Carrefour and Better Life, which are in direct competition with Yonghui Superstores, apparently runs against the conventional investment logic.

After all, it’s not like that the business of the three can be integrated after the investment. In fact, it won’t even change the competitive nature of their relationships.

4. Why was Yonghui Superstores co-investing with Tencent?

Tencent injected 4.2 billion and 5 billion yuan into Yonghui Superstores and Vip.com respectively. Although comparable in size, they translate into different shares and different values for Tencent.

In the announcement detailing the Carrefour deal, an emphasis was given to Tencent’s technological strength, as well as Yonghui Superstores’ operational experience and advantage in the fresh food sector. The latter, according to some industry analysts, is clear indication that Yonghui Superstores intends to build itself into a retail supply chain operator.

Once you have the answer to the above four questions, you’ll be able to see through Tencent’s recent binge-buying of retail assets and, moreover, the forthcoming battle between Tencent and Alibaba on the new retail front.

What’s Tencent’s next step?

Typically, an investment may come with a financial or strategic purpose, but Tencent’s recent investments are different. The company has created a new category – investment for the sake of building alliances.

In other words, Tencent’s investment is a gesture that tells the world it’s doubling down on new retail. It needs to bring those companies “under its umbrella” to prepare itself for the upcoming battle on the new retail front.

1. It’s never too late to make remedies

As Tencent has not positioned retail as its main business, it takes some time for the company to realize that it should make investments in brick-and-mortar retail, or will be late. However, it’s never too late to make some remedies. In fact, the number of outstanding or qualified offline retailers is limited and the list of China’s Top 10 retailers leaves little choices for Tencent.

Given that Alibaba has achieved cooperation with several leading companies in this sector, Tencent has to make a quick response to avoid a worse situation, which results in the investment binge.

2. Tencent carries expectations from offline retailers

It’s a common sense that the concept of New Retail was proposed, advanced and defined by Alibaba. Therefore, Tencent, JD, and Suning (Chin’s leading retailer of electric equipment) developed Unbounded Retail, the fourth retail revolution and Smart Retail respectively, trying to up the ante in battle with Alibaba in the new retail area. Although these synonyms of New Retail have limited impact on the competition, they indicate that a new era of Internet-driven retail has begun.

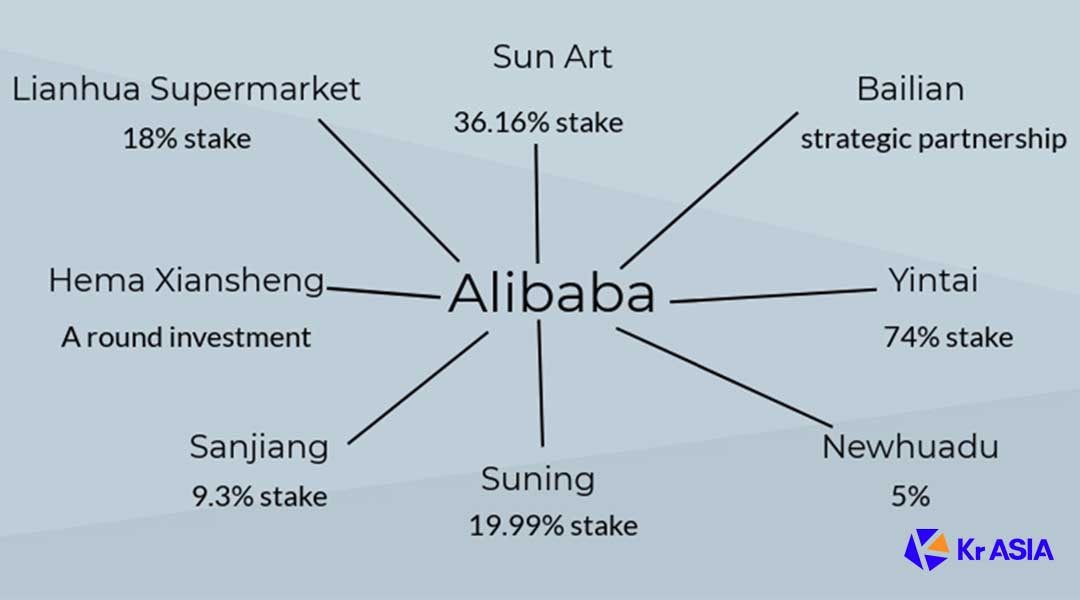

The companies receiving Tencent’s investment have also reached out to Alibaba before, from which HLA, a retail brand for menswear, won great support from Alibaba’s e-commerce website Tmall and reached an agreement on comprehensive cooperation with Alibaba in August 2017. Nevertheless, not all of the offline retailers want to give up themselves to Alibaba, as with Yintai, BL.com and Sun Art Retail (RT-Mart).

Read more: Tencent Acquires 5% Stake in Menswear HLA, Branching out to Beachhead in New Retail

Alibaba usually takes the following two conditions when chooses its investees. First, it’s better if the companies have no problem in finance, cross-shareholding, and operation. Second, Alibaba wants the offline retailers it invested in to help it complete three chains: brand—retailer—consumer, online business—offline business—cross-area business and data—product—trading and delivery.

The above mentioned two conditions can be used to explain why Alibaba didn’t realize cooperation with the offline retailers that were eventually invested by Tencent and why Alibaba has not yet decided to invest those under discussion.

Another reason is that Alibaba puts too many requirements and limitations on companies it invested in and asks for too much payback. As founders of the offline retailers leaving Alibaba for Tencent are young and ambitious, they don’t want their achievements to be taken over by others.

However, surviving from competitions in O2O and Internet+ makes these founders acknowledge that they are lack of ability to establish a successful Internet methodology in the Internet-driven retail industry.

In response to the dilemma, these retailers should cooperate with a company enjoying an ability to compete with Alibaba in Internet technology as well as having a complete plan and ambition in offline retail, while having no intention to control them.

Tencent is the one meeting all of the prerequisites. The year of 2018 is facing a great change in new retail industry, where players are experiencing cooperation and competition. Therefore, the rising of Tencent in retail has satisfied many expectations.

Its recent investment deals have won great acclamation from retailers.

Read more: Alibaba Just Ordered a Takeout for its New Retail Future