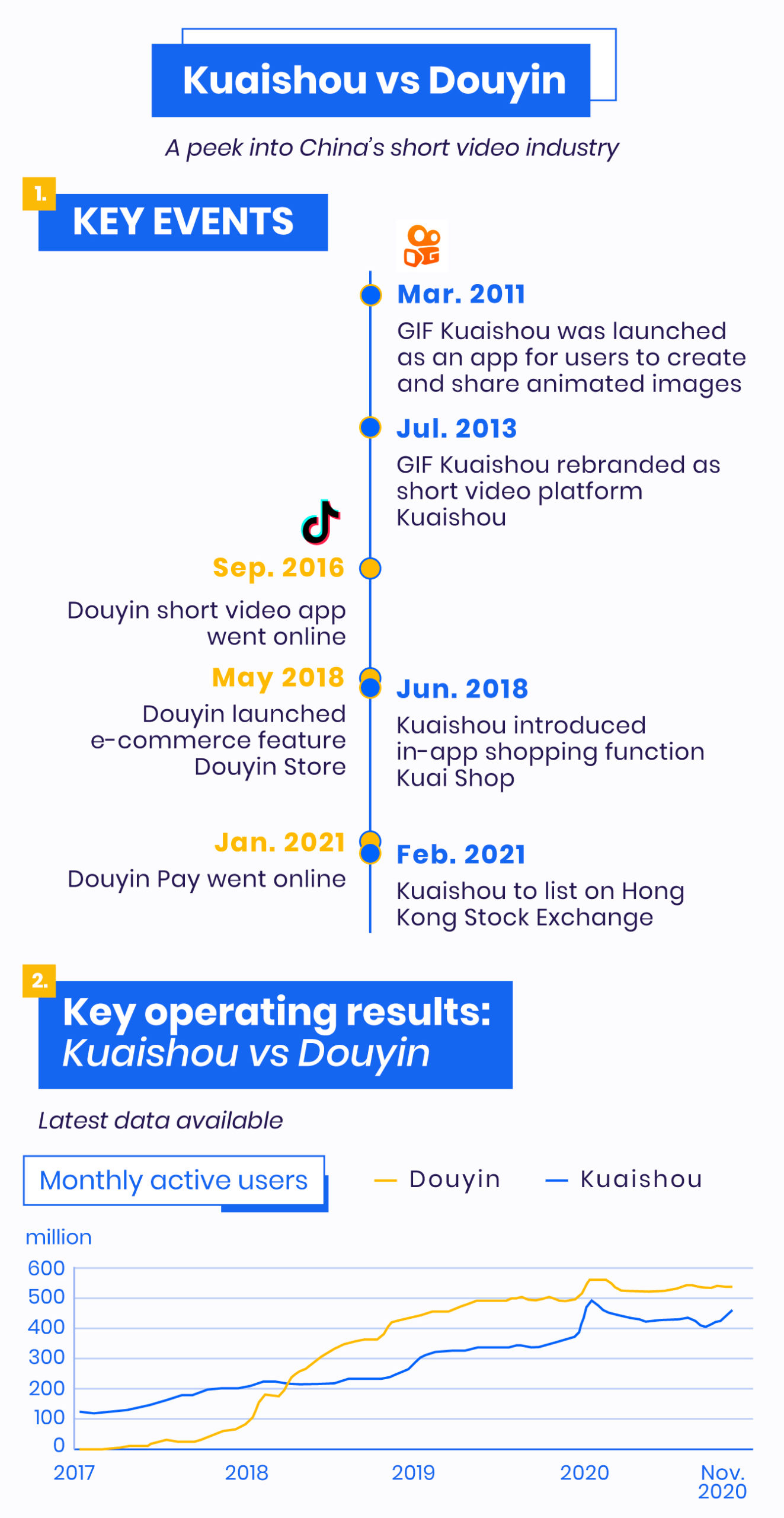

The short video sector has its roots in animated GIFs in the early 2010s. It took off in 2018 as a new, light way to share content. On Friday, Kuaishou Technology’s shares will be traded in the first ever short video stock offering. For now, Kuaishou is the second most used short video app in China. A week before it rang the bell, its retail share allotment was oversubscribed by more than 400 times.

In the meantime, Douyin, the Chinese twin of TikTok, is in a race with Kuaishou to lure eyeballs. TikTok may go public on the same bourse too, according to 36Kr.

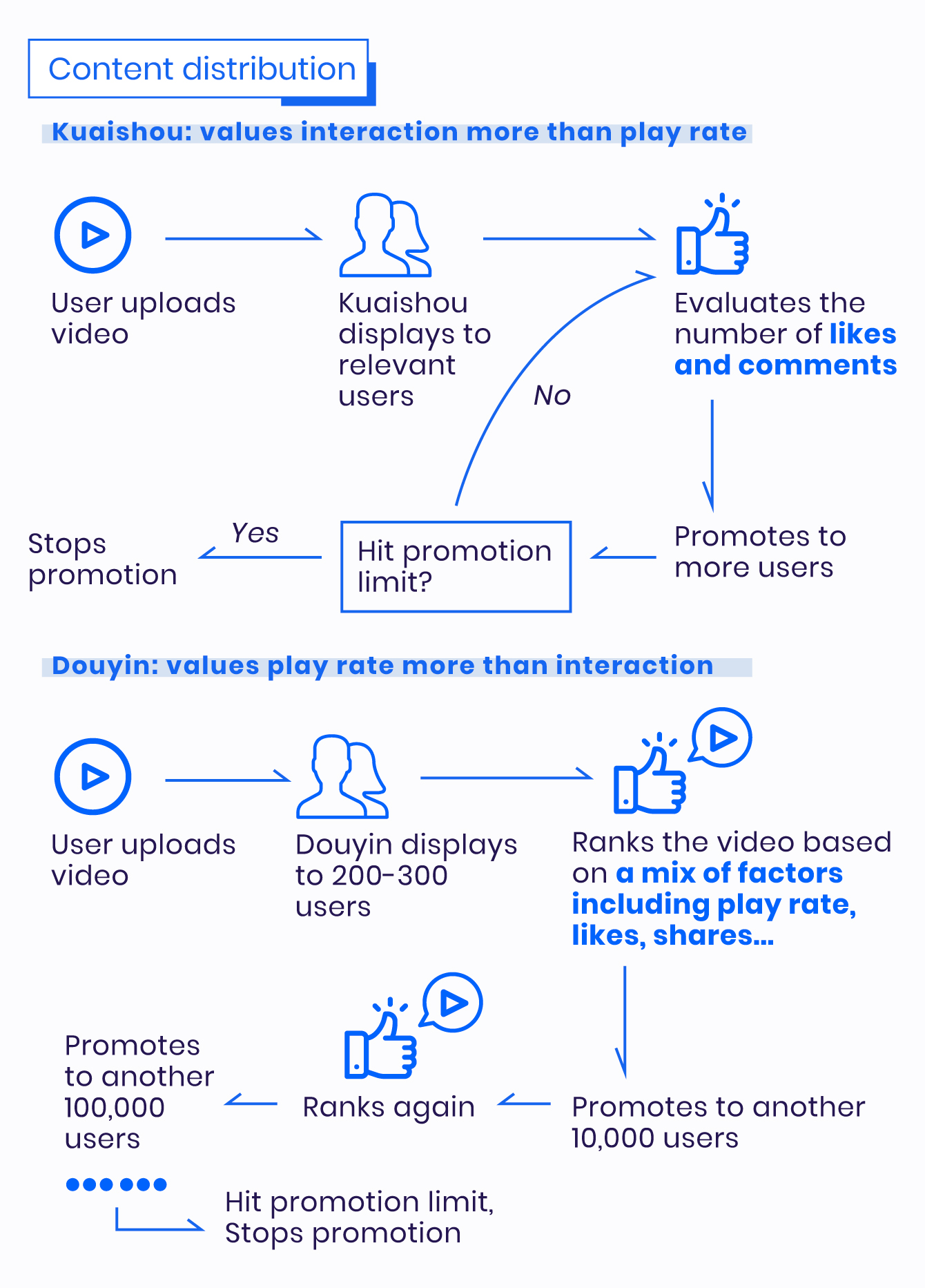

As the most popular short video apps in China, Douyin and Kuaishou are fundamentally different. Kuaishou resembles a social community, where fans mingle and interact with KOLs, while Douyin has strong genes as a media and entertainment platform, where content quality and information distribution are key traits, according to a Founder Securities research report.

The difference is demonstrated in every corner of these two apps’ ecosystems: livestreaming and short video KOLs on Kuaishou form “families” and take on “apprentices.” These “families” share revenue, and “masters” farm out some interactions with fans to their “apprentices.”

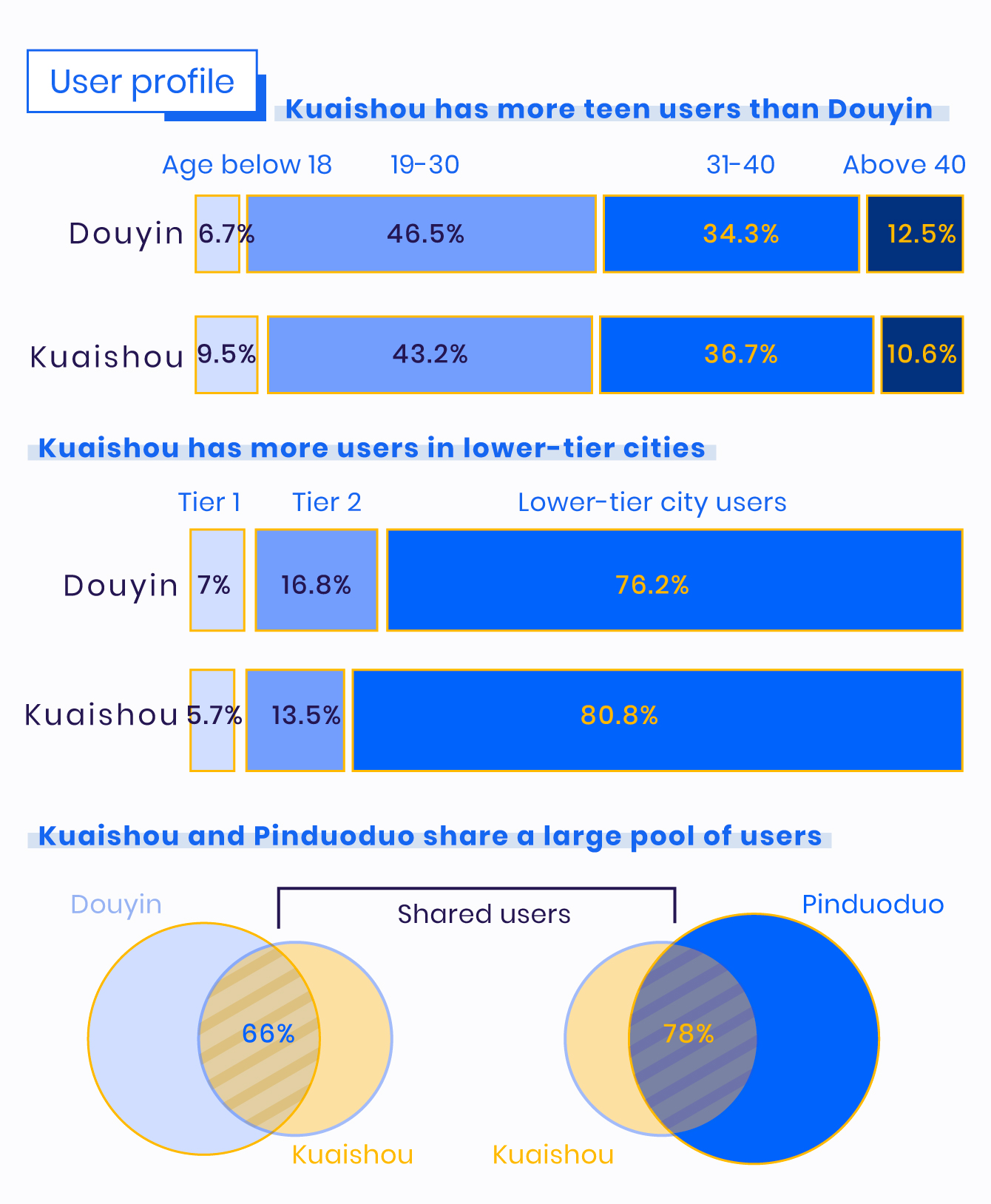

This may have to do with Kuaishou’s user demographics: Kuaishou has more teenagers and people from lower-tier cities on its platform. These users, according to Founder Securities, favor strong affiliations with the content creators they follow on screen. In fact, Kuaishou’s user base overlaps significantly with that of Pinduoduo, an e-commerce app that is popular with price-sensitive shoppers—more so than with Douyin, according to data from Analysys.

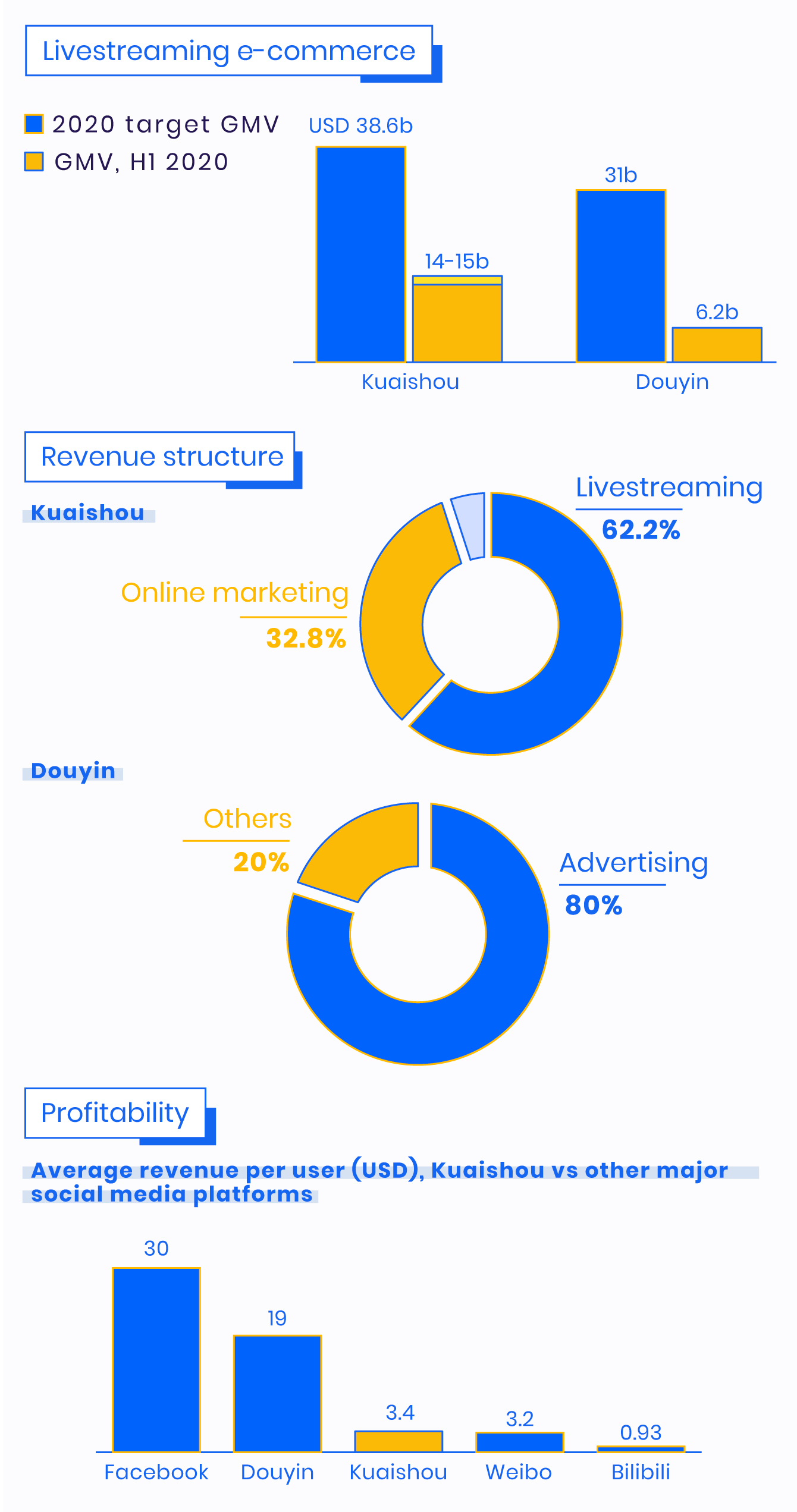

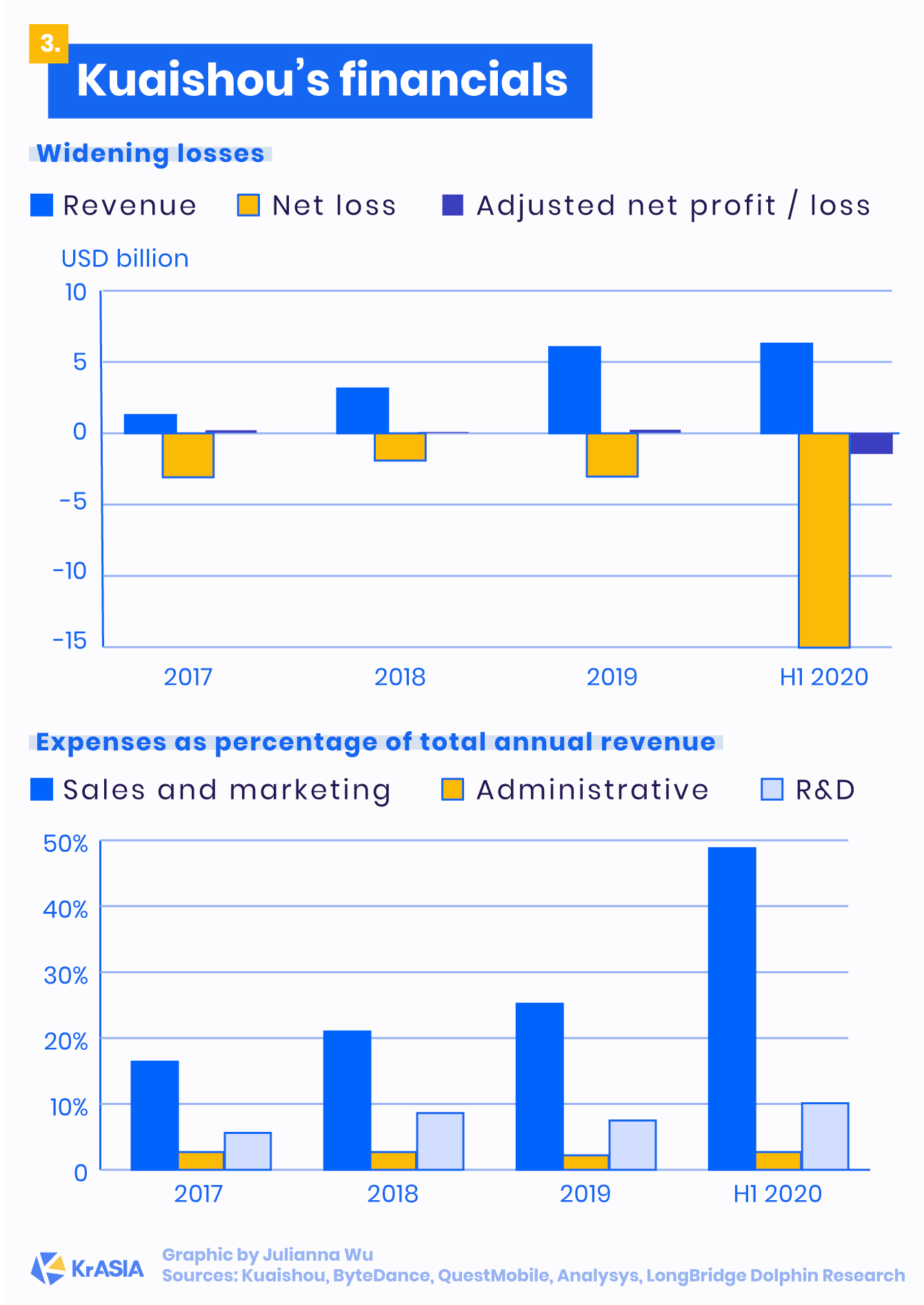

In Kuaishou’s latest financial reports, 62.2% of revenue is from livestreaming, while most of Douyin’s earnings are drawn from advertising. In fact, thanks to Douyin, parent company ByteDance became China’s second largest digital ad player in 2019.