As the pursuit of a healthier lifestyle is growing among Chinese residents —either for the better body shape or to relieve stress— fitness startups have sprung up in China to provide innovative and more flexible workout options, disrupting an industry dominated by traditional gym franchises.

Shape, or Sujianshen in Chinese, is one of them. The startup was founded in 2018 by Zeng Xiang, who formerly worked for Chinese sportswear giant Li Ning as an e-commerce director and ride-hailing unicorn Didi on its overseas expansion. With the vision of creating a fitness brand to give Chinese youngsters easier ways to work out, Shape launched a mini program on WeChat to allow its users to book curated group fitness courses, including yoga, Zumba, and body combat, among others.

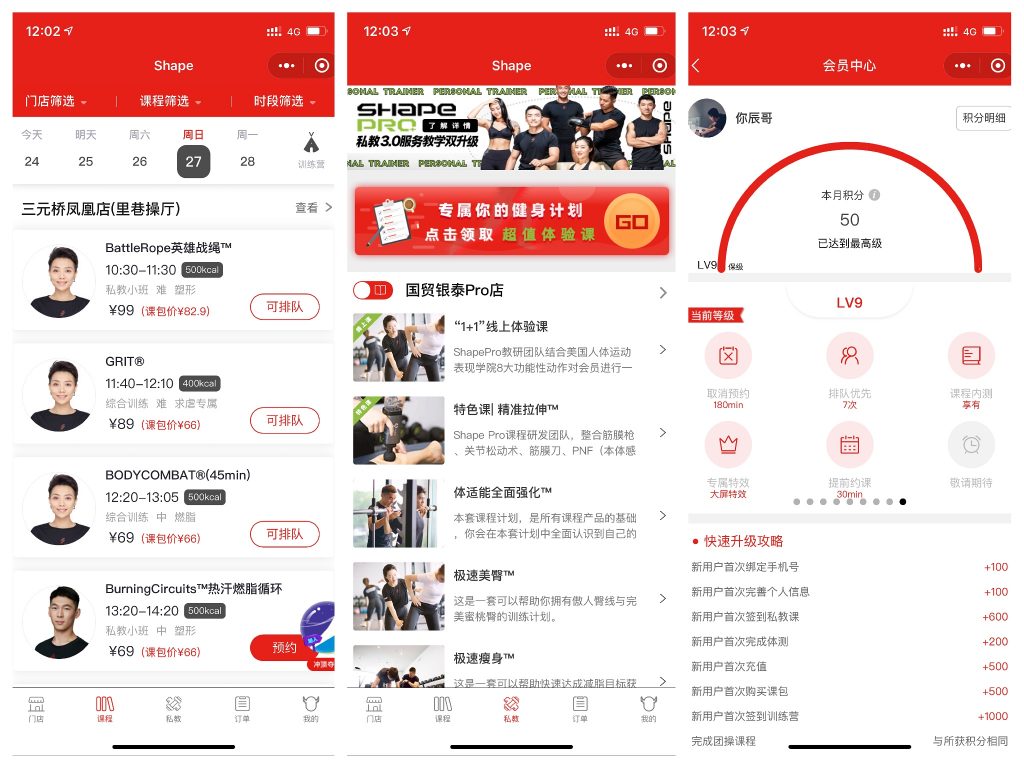

Shape’s courses are payable online, and users only need to pay for the selected class or training session. Customers can also book personal training classes, and go to Shape’s physical stores to sweat it out.

“As the pace of life is changing, exercise solutions are in high demand,” Zeng told KrASIA.

Gyms were among the most hard-hit businesses in China, due to the long lockdowns in response to COVID-19. However, most centers have started to open again in the post-pandemic period since May. In China, traditional gyms usually charge an annual, half-year, or three-month membership fee, with shorter time options traded at more expensive prices.

“Traditional gyms usually operate on a prepaid model, which makes them sales-focused instead of service-focused,” Zhang explained, adding that Shape wants to lower the entry bar for gym-goers by providing a variety of professional but not expensive options.

According to Zeng, Shape’s model experienced iterations and evolutions. First, his team tried to focus on “unmanned gyms,” with minimum staff and powered by screens with instructions for users, but it didn’t work out, due to the lack of “immersive experience.” Shape then decided to target group training classes, but currently, the firm focuses on a model that predilects personal training sessions (attracting most users from group courses), gyms in main central business districts, and brand’s empowerment.

“The gross profit of group training classes is too low. Personal training sessions are becoming the main revenue drivers,” Zeng said.

In August, Shape raised RMB 20 million (USD 3 million) in its A+ Series led by Hangzhong Holdings Group, bringing the company’s total fundraising to over RMB 100 million (USD 15 million). Its former backers include seed-stage focused venture Zhen Fund and Crystal Stream Capital. The new funds will be used to hire new trainers, renew facilities, and provide more course options.

Read more: China’s fitness industry goes pay-per-workout via mini programs

A fresh fitness brand to disrupt traditional gym models

Shape now has 10 storefronts in Beijing with around 60 professional trainers. The number of signups surpassed 140,000 and monthly active users (MAUs) are currently over 5,000.

Shape’s service is accessible from a WeChat mini program. To book a fitness course, users can filter by time slots, storefronts, and courses. Shape curated nearly 50 courses to meet different users’ needs.

The price per class, which usually takes an hour, ranges from RMB 39 (USD 6) to RMB 99 (USD 15). Meanwhile, for personal training sessions, one-hour costs from RMB 350 (USD 51) to RMB 450 (USD 65).

Shape’s gyms are located in central business districts. The location is related to the demographics of its customers, Zeng explained. “A majority of customers are young white-collar female workers and they cluster in certain commercial zones,” he said.

“We take a game-based approach to the fitness experience,” Zeng added. To further engage users, the firm provides a fitness band to its users, which traces athletes’ movements and records data such as heart rates and calories. The exercise data is displayed on screens hung on the walls and can be used to rank trainees’ performances.

“Higher ranks mean more credits and discounts in purchases,” he explained, adding that the technology benefits Shape’s customer relationship management.

However, the most important thing to retain users is high-quality trainers, according to Zeng. Therefore, Shape sets high standards for its trainers. “Only candidates with professional certificates can join the team,” he said.

“New-style” gyms on the rise

In recent years, an array of Internet-powered gyms, also so-called “new-style” fitness startups have drawn attention from investors, including Hangzhou-based Lefit, Beijing-based Keep, and Shenzhen-based Super Monkey.

“Firstly, it’s the operation mode, leveraging the Internet wisely in user growth and management. Secondly, a younger brand image. Thirdly, we are more sensitive to users’ experience,” Zeng explained.

Among competitors, Lefit’s provides gyms open 24 hours, seven days per week, with training classes accessible from the company’s app. Tencent-backed fitness unicorn Keep, instead, started as an online wellness content platform and stretched its business to offline gyms and online sales of exercise machines. Super Monkey, on the other hand, specializes in group classes and has a large following in metropolitan cities like Beijing and Shanghai.

However, the COVID-19 pandemic has severely hampered the industry’s growth momentum. During the lockdowns, to manage costs, Shape had to lay off about 50% of the staff at its the main office, closed two gyms, and shelved plans to expand in Shanghai and Shenzen by 2020. The company also implemented livestreaming fitness classes in a bid to engage home-holed clients.

“We just wanted to survive,” Zeng said.

In Zeng’s opinion, transforming the fitness industry in China is a long-term mission. “We hope to be a wave-maker in the industry. Shape doesn’t necessarily have to be the first one, but we will contribute continuously.”

This article is part of KrASIA’s “Inside China’s Startups” series, where the writers of KrASIA speak with founders of tech companies in the country.