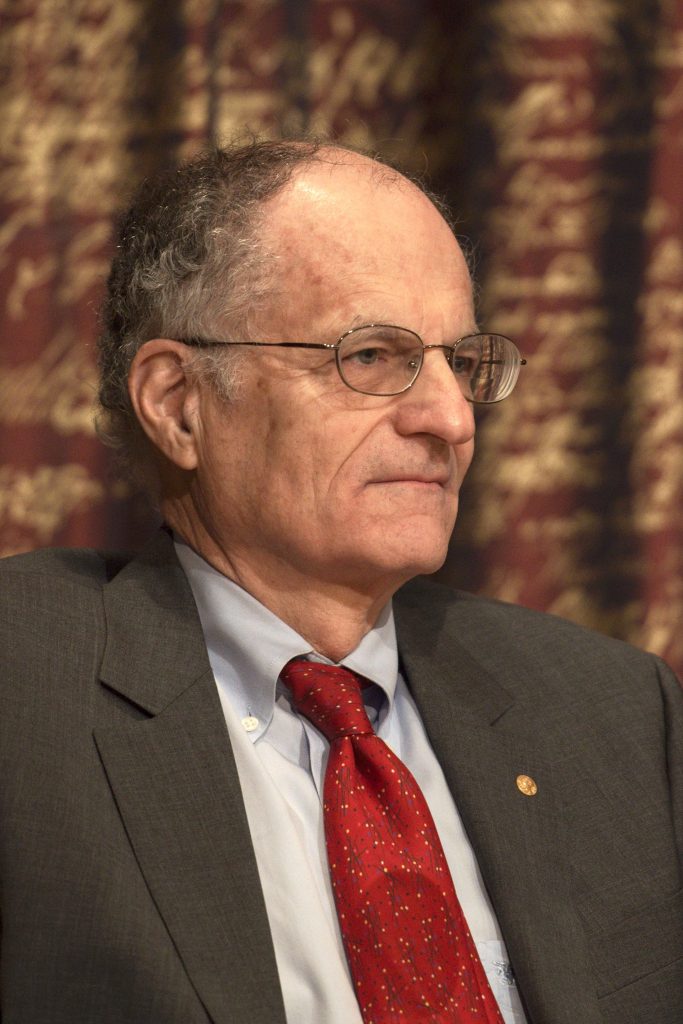

China’s annual tech conference WISE concluded the 2-day event with a speech by prominent American economist Thomas Sargent. The Nobel Laureate winner, who has revolutionized the field of macroeconomics with the ‘rational expectations theory’, offered an interesting perspective of China’s decade-long tech advancements, in addition to sharing his thoughts about the current challenges faced by the Chinese tech community.

The overarching theme for WISE this year is this: “New Economy”. While the most accurate definition of the phrase is still up for debate, it essentially refers to the encompassing tech-enabled ecosystems we see in China today whether it be in social media, gaming, e-commerce or even at the intersection of tech and traditional sectors, such as new retail.

Under the new economy theme, in recent years Chinese companies have gone both digital and global.

Going digital has changed how the traditional economy functions. And competition has gone global. Alibaba and Tencent became the top 10 most valuable brands at the beginning of 2018. Who would have thought or known that online platforms – something that’s not tangible – can become a valuable brand?

What is surprising is not China becoming a powerhouse, but rather the speed and acceleration that China experienced over the past decade. Consider the Nasdaq-listed Pinduoduo, this group buy Chinese e-commerce platform took a mere 3 years to go public, beating predecessors Alibaba (15 years) and JD.com (16 years). It seems to be only getting faster.

So what drives this new economy?

Sargent identified two core factors that have led to the explosion of the technology wave that has catapulted China into one of the pivotal economies of the world today, namely international trade and, China’s ubiquitous mobile computing power.

International trade exploits the economics of comparative advantage – letting people do what they do best is one major engine to spur innovation. China opened itself to the world, both in terms of international trade of ideas and also goods and services. People from all walks of lives start to interact and exchange ideas more.

On another note, as diverse people communicate more, human connection is further enhanced. The lines between academic researchers and scientists at tech giants like Baidu, Alibaba, Tencent, Google, Facebook etc are also blurring. These intersections of ideas across various advanced fields from computing, economics, statistical physics, coding, decoding, information theory, geometry, mathematics to physics breed new ideas, creating the spark for creativity that leads to innovation.

This narrative is very much in line with Italy’s Renaissance period, where curiosity drove the people to explore other cultures from ancient Greece, the Ottomans’ empire to even Egypt. Its achievements were also spread across a wide variety of areas from painting, architecture, sculpture, music, and exploration.

The second factor was the widespread amount of data and computing power at our disposal today. China has effectively leveraged the huge source of digital data and ubiquitous computing power. By ushering the age-old statistical concept onto the data, it has produced many of the wonderful apps that the Chinese enjoy today. Curated content, communication device, food delivery are just some examples.

Is China creating a tech bubble?

Having discussed at length about all the possible drivers for China’s tech ecosystem, one inevitable question tends to crop up – Is there a technology bubble in China? Sargent shared some thought-provoking ideas with KrASIA at the sidelines of the event.

The first foundation he laid was the distinct difference between risk and uncertainty. Risk is basically a measurable figure done via mathematical conclusions over given sets of data, pretty much how insurance today works. Uncertainty, on the other hand, is simply unknown.

Digital entrepreneurship hovers on the uncertainty realm. Statistically, 95% of new ideas fail, but each crazy idea is uncertain.

Essentially, this means it is impossible to judge if there is a real bubble, where assets are overvalued as there is no credible way to value an entrepreneur’s firm without any data.

Sargent illustrated his point further by giving an illustration of fiat currency. “ I give you a dollar because I trust that you will value it and this belief has to go on or this bubble will burst,” he adds. Paper money has no fundamental value. And this is the bedrock of our modern economy. The market at any given point in time will have both optimists and pessimist; the optimist will buy, hoping to sell to an even more optimistic person.

Ultimately, the bigger question behind the bubble is this: do more Chinese still believe in the future of technology today? If the answer is yes, the bubble can continue and that’s not necessarily a bad thing.

Editor: Ben Jiang