In 2020, Tencent’s investment in India’s Swiggy, Alibaba’s investment in Indonesia’s Tokopedia, and Tokopedia’s potential merger with Tencent-backed Gojek all made headlines. They’re all part of a larger trend. Over the past five years, Chinese firms have poured billions into tech startups in the region, seeking to replicate domestic successes in new markets in Southeast Asia and India with familiar demographics highlighted by young, mobile-savvy populations.

While Chinese tech giants’ efforts in recent years to expand their own brands abroad have met roadblocks, like Alibaba’s foray into India, investments in fully localized companies offer an attractive alternative. As Alibaba, Tencent, and other Chinese firms with capital to spare consider where to offload their balance sheets, tech startups in India and Southeast Asia have become a cornerstone of many competitive Chinese firms’ venture capital portfolios, fueling the rise of some of the hottest names in the industry.

China is Asia’s largest source of venture capital

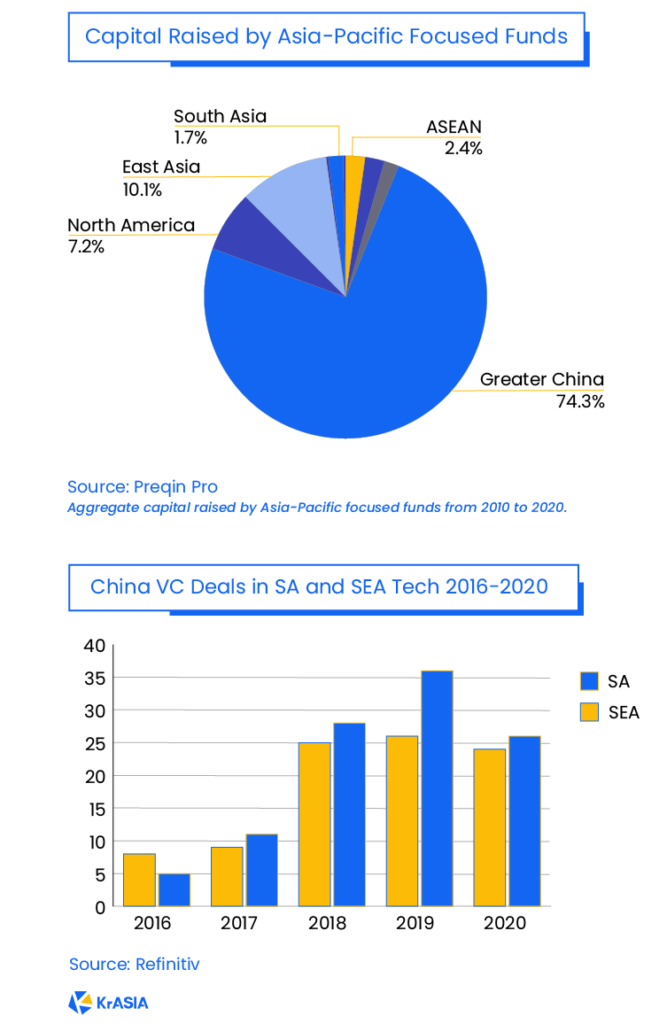

Greater China holds the lion’s share (74.3%) of institutional private equity and venture capital raised for Asia-Pacific-focused investments, per Preqin. Although Chinese funds focused more heavily on startups at home than in India and Southeast Asia, the number of deals in those regions more than tripled over the last five years. With record-high levels of dry powder in Asia, low interest rates, and rising investor demand for IPO opportunities, China’s private equity circles expect to see new growth in 2021. Similar progressions will likely unfold in Asia more broadly.

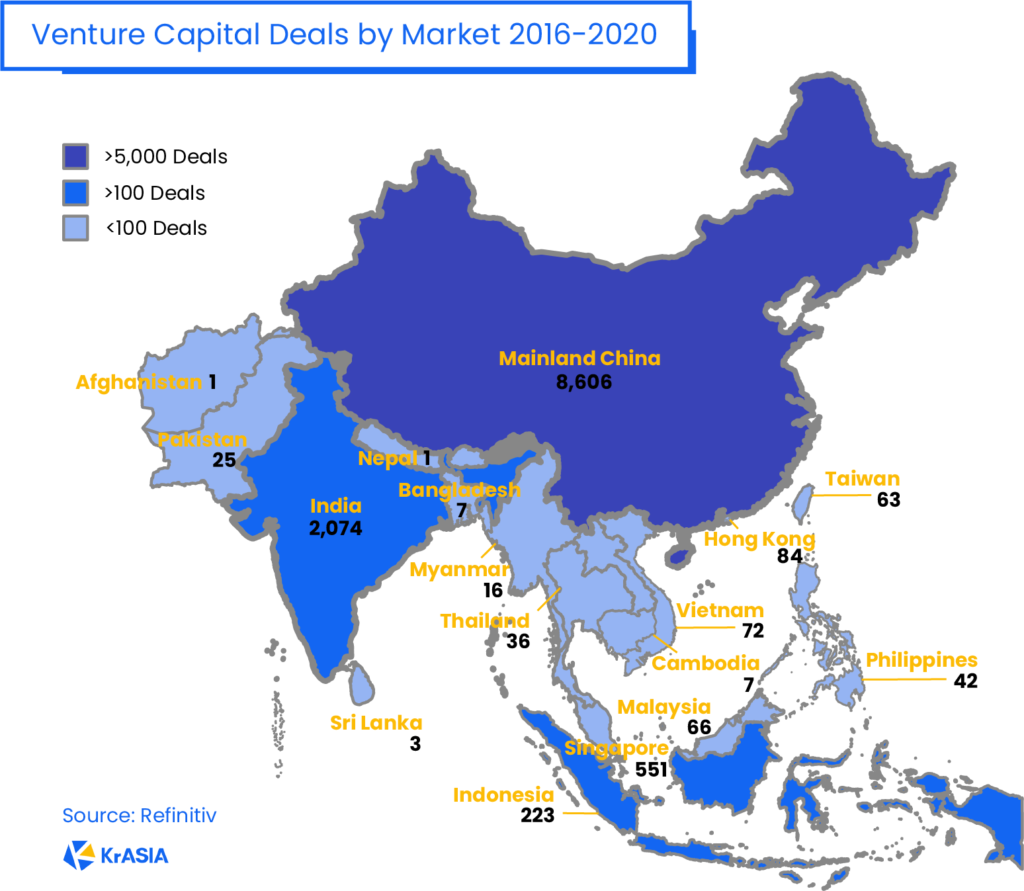

Outside of China, most deals took place in India, Singapore, and Indonesia

Most private equity deals in Asia over the past five years were concentrated in just a handful of countries. The most robust venture capital environment over this period was in China, where there were at least 8,606 venture capital deals recorded between 2016 and 2020, according to data from Refinitiv. Nearby, India, Singapore, and Indonesia dominated, with 2,074, 551, and 223 deals respectively, while most other countries in the region hit double digits.

India, Indonesia, and Singapore are also home to many of Asia’s most valuable unicorns, or privately held tech startups valued above USD 1 billion. Among the top 500 unicorns worldwide, more than half of those hailing from these three countries raised funds with Chinese venture capital, mainly piped in from Tencent and Alibaba.

Singapore and Indonesia highlight Southeast Asia’s market diversity

It takes just an hour and 40 minutes to fly between Singapore and Jakarta, yet the two places couldn’t be more different.

Home to 7.5 million people (that’s smaller than New York, and would not even break the ranks of China or India’s 15 largest cities), Singapore’s developed infrastructure and highly educated workforce draw investment in deep tech startups in technologically advanced fields. For Singaporean startups to succeed, they often tap talent from beyond their borders. As a result, startups in Singapore tend to establish broader appeal to nearby markets in Southeast Asia from the outset, earning the city a reputation as a regional enabler.

By contrast, as the world’s fourth-largest country by population size, Indonesia boasts strong domestic demand and local growth potential. Its digital economy is dominated by e-commerce, driving more than half (54%) of the sector’s year-on-year growth. For instance, consider the difference between Singapore’s Grab, which launched in several countries within a year after its debut, and Indonesia’s Tokopedia, which launched with a decidedly local focus.

A rising star in Vietnam

After Indonesia, Vietnam’s digital economy is projected to grow the most between 2020 and 2025. Although still far behind Singapore and Indonesia in the number of deals and equity invested, it’s also worth noting that partly as a result of the trade tensions between the US and China, Vietnam has seen an influx of investment from multinationals looking to diversify supply chains from China, with knock-on effects. Between 2017 and 2019, technology deals grew sixfold, launching Vietnam into the ranks of ASEAN’s top three startup markets, with strong progression across verticals except for travel in 2020.

Geopolitical tensions dampen Chinese deals in India

Following the Indian government’s regulations curbing foreign investment, military clashes between China and India in the Himalayas, and a ban on hundreds of Chinese apps last year, new investments from China in India have declined, with hundreds of Chinese proposals worth over USD 2 billion caught in the pipeline.

In August, Alibaba announced it would put new investments in India on hold for at least six months. For now, China remains India’s largest trading partner, and the country’s vibrant tech sector still attracts a lot of interest from Chinese investors. But foreign investors might think twice about new commitments while the Indian government reconsiders how much foreign capital they allow to flow through their borders.

New users who came online during the pandemic are here to stay

In Southeast Asia, 40 million new users came online last year. More than one-third of them began utilizing new services because of COVID-19, and 94% of consumers intend to continue using those services post-pandemic, according to a report by Google, Temasek, and Bain & Company. Education technology, grocery delivery, and lending services benefited the most from new consumers. E-commerce remains the largest category of internet services in the region, comprising over half of gross merchandise value, followed by food and transport.

Chinese venture capital has proven increasingly important in developing Asia’s digital economy. What remains an open question, however, is how Chinese companies can foster continued growth once their investees have established initial traction in their respective economies, and withstand the impacts of regulatory developments constricting capital outflows.