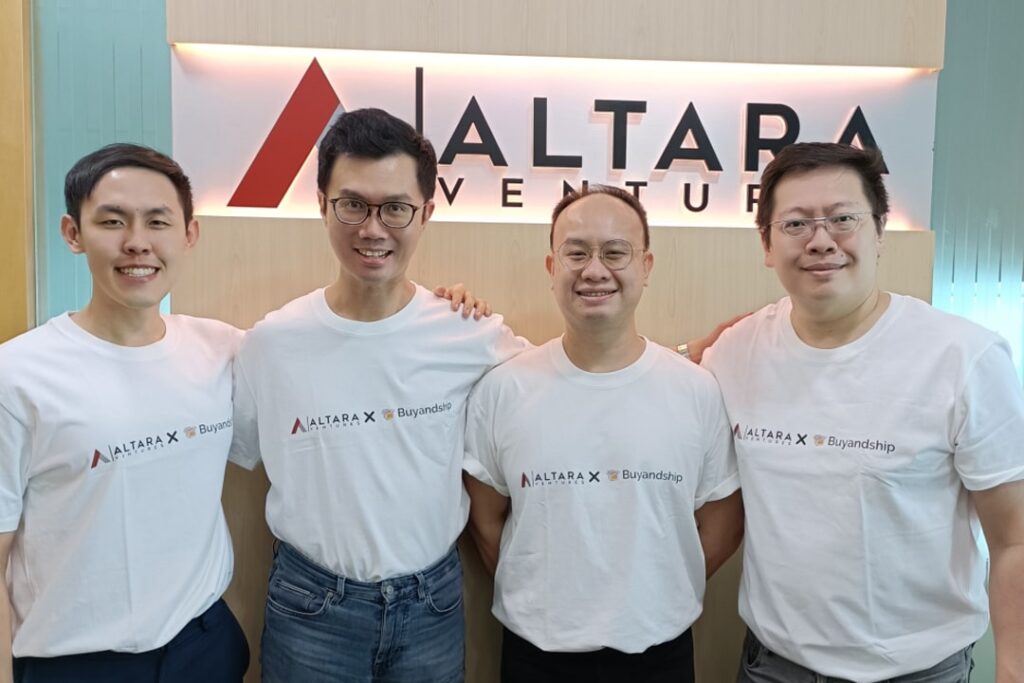

Buyandship raises USD 6 million in Series B extension

Buyandship, a cross-border e-commerce enabler based in Hong Kong, has raised USD 6 million in an extension to its Series B round. Led by Altara Ventures, other investors include KSK Angels, AVA Angels, and Venture University.

This extension brings the total amount raised by Buyandship at Series B level to USD 16 million.

Buyandship will use the funds to enhance the user journey in product search and purchase, expand into new markets in Southeast Asia, and further automate operations.

Peak3 raises USD 35 million in Series A funding

Peak3 (formerly known as ZA Tech), a digital and cloud solutions provider for the insurance industry, has raised USD 35 million in a Series A funding round. The round was led by EQT and included participation from Alpha JWC Ventures.

The company plans to use the funds to accelerate its expansion in the EMEA region and invest in complementary data and AI solutions.

Amartha secures USD 17.5 million from Accion

Amartha, a Jakarta-based microfinance fintech platform, has secured USD 17.5 million in equity investment from the Accion Digital Transformation Fund.

The funds will help Amartha expand its platform, providing financial products and services to underserved women-led small businesses in rural Indonesia.

LD Carbon closes USD 28 million Series C funding round

LD Carbon, a Seoul-based producer of recovered carbon black, has raised USD 28 million in a Series C funding round. The round was led by Toyota’s growth fund Woven Capital, with participation from Meritz Securities, Investwith, Industrial Bank of Korea, the Zer01ne platform under Hyundai Motor Group, Elohim Partners, and New Main Capital.

The company plans to use the capital to scale operations for recycling end-of-life tires into recovered carbon black and pyrolysis oil.

Nota AI raises USD 19.9 million in Series C round

Nota AI, a South Korean startup specializing in AI optimization and lightweighting technology, has raised USD 19.9 million in a Series C funding round co-led by STIC Ventures and LB Investment, with new investments from Korea Development Bank and Mirae Asset Securities, among others.

The startup intends to use the funds for talent recruitment and to enhance collaborations with global AI semiconductor companies.

STT GDC receives USD 1.3 billion investment from KKR-led consortium

ST Telemedia Global Data Centres (STT GDC), a data center colocation services provider, has received a USD 1.3 billion investment from a consortium led by KKR and Singtel.

This transaction includes an initial USD 1.3 billion via redeemable preference shares (RPS) with detachable warrants, with the potential for an additional USD 920 million upon full exercise of the warrants.

Singapore-based Lanchi Ventures leads seed investment in Genspark

Genspark, an artificial intelligence search startup founded by former Baidu executives, has raised USD 60 million in an oversized seed funding round led by Singapore-based Lanchi Ventures.

The company plans to use the funds to develop its AI-powered search engine, which aims to challenge Google’s dominance by providing customized pages for each query.

Recent deals completed in China:

- Zolwise, a Shanghai-based provider of minimally invasive surgical imaging equipment, has raised over RMB 100 million (USD 13.8 million) in Series B+ and B++ funding rounds. The investors include Jiangxia Science and Technology Investment Group, Zhuoyue Jinke, and Hengjin Capital. The funds will be used to expand marketing channels, promote products, and strengthen manufacturing and industrialization efforts. —36Kr

- ChainGen Bio (CGB), a company specializing in drug conjugation and delivery technology, has completed a new funding round exclusively invested by the first phase of Zhangke Hemiao Fund. The capital will be used to attract high-level talent, advance IP and pipeline development, and complete clinical validation of its inaugural product. —36Kr

- SPOE, a Shanghai-registered developer of optoelectronic products, has completed its angel funding round, exclusively backed by China Fortune-Tech Capital. The funds will be used for the R&D of new products, such as fiber optic interferometers, further expanding the company’s capabilities in high-precision displacement measurement. —36Kr

- Guangzhi Technology, a Wuhan-headquartered advanced industrial laser company, has announced the completion of nearly RMB 100 million in a Series B funding round. Fortune Capital and Yichen Capital invested in this round, with Qichen Capital serving as the sole financial advisor. The funds will be used for production line expansion and new product development. —36Kr

- LeeKr Technology, a Hangzhou-based intelligent chassis systems provider, has secured over RMB 1 billion (USD 138 million) in a Series C funding round. The round saw participation from various investors including the Hangzhou Fuchun Bay New Town Development Fund, CyberNautea, Hefei Construction Investment and Holding, Hefei Baohe Linghang Fund, Baohe Kechuang Fund, Sealand Innovation, Ruicheng Fund, Huaying, SRIC Investment, and Shengrui Duxing. —36Kr

- HPMicro, a high-performance microcontroller manufacturer, has completed a new funding round, raising a sum totaling nearly RMB 100 million. The round was led by Silicon Paradise, with participation from Tianjin Yongti Haihe Investment Management, Hangzhou Yuanyan Equity Investment, and 3onedata. The funds will be used to expand its microcontroller product line and further its market development in industrial automation, new energy, and automotive electronics. —36Kr

- BioGeometry, a developer of generative artificial intelligence foundation models for protein design, has completed a new funding round. The investors include The Jiangmen, Zhipu AI, and Peakview Capital, as well as additional investment from existing shareholder Gaorong Ventures. The funds will be used to accelerate the application of generative AI models in the biomanufacturing field and to advance the development of its proprietary products. —36Kr

ArrowBiome, Betashares, Grinergy, and more led yesterday’s headlines:

- ArrowBiome, a biotechnology company based in Singapore, has announced a USD 1 million seed funding round, invested by early-stage venture capital firm Cocoon Capital.

- Betashares, an Australian financial services company, has entered into a binding agreement for Temasek, a global investment firm headquartered in Singapore, to invest up to AUD 300 million (USD 198.7 million).

- Grinergy, a South Korean startup specializing in lithium-titanate (LTO) batteries, has announced an investment agreement with an unnamed global investment group based in North America. This partnership aims to facilitate Grinergy’s entry into overseas energy markets, including North America, Europe, and the US.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].