k-ID secures USD 45 million in Series A round co-led by Andreessen Horowitz and Lightspeed Venture Partners

k-ID, a Singapore-based startup that provides a cross-platform, instant sign-on solution for kids and teens, has announced a USD 45 million Series A funding round. The round was co-led by Andreessen Horowitz (a16z) and Lightspeed Venture Partners, with additional support from Konvoy, Tirta, Okta, and Z Venture Capital (LY Corporation).

The completion of this round brings k-ID’s total funding to USD 51 million.

k-ID’s platform simplifies online safety and privacy management for game developers, parents, kids, and teens. “Kids today make friends and countless memories inside games and virtual worlds, and parents need modern tools to keep them safe,” said Jonathan Lai, general partner at a16z. “k-ID is serving this need and defining a new industry standard for digital youth safety.

Pawprints Group secures extension to seed round from Asia Fund X to advance sustainable pet nutrition

Pawprints Group, a Singapore-based company specializing in “biologically ideal and allergy-friendly pet nutrition,” has announced an extension to its seed funding round led by Asia Fund X (AFX), an opportunity fund supported by MSW Ventures and anchored by Pavilion Capital.

This investment follows an initial USD 1.7 million seed round in November 2023 and includes backing from existing investors Creative Gorilla Capital and the Japfa Comfeed family office Altrui Investments.

Founder Jacqueline Sulistyo highlighted the company’s mission to redefine pet nutrition with high-quality, sustainable options that cater to pets with allergies and dietary sensitivities. Pawprints said it has achieved strong market fit, doubling its monthly revenue since the launch of its signature brand in June 2023 and completing over 35,000 orders. The company plans to introduce more than ten new product SKUs by the end of 2024 to capitalize on Asia’s growing pet care industry.

Earth VC invests in cultivated meat startup Orbillion Bio

Earth Venture Capital (Earth VC), a climate tech venture capital firm based in Vietnam, has announced its strategic investment in Orbillion Bio, a US-based cultivated meat startup.

This investment, co-led by The Venture Collective and At One Ventures, with participation from Y Combinator and Metaplanet, aims to scale up Orbillion’s production and further develop its technology.

Founded in 2020, Orbillion Bio specializes in producing Wagyu beef cells and aims to be a leading B2B supplier of beef muscle and fat cells. The company has demonstrated significant progress, achieving a 200-liter production run in Singapore in a notable timeframe. The company has also partnered with Luiten Food to bring cell-cultured Wagyu beef to over 35 countries, pending EU regulatory approval.

This funding will enable Orbillion to set up operations in Singapore, targeting the Asian market with its technology.

Plaza Premium Group commits USD 300 million to enhance airport hospitality services

Plaza Premium Group (PPG), an airport hospitality services provider, has announced a USD 300 million investment to drive innovation and growth over the next three years.

With a global footprint of 250 locations in over 80 airports and 30 countries, PPG will utilize the funds to enhance customer experience through sustainable solutions, cutting-edge technologies, and strategic market expansion.

Key areas of investment will include expanding operations in the Asia Pacific, the Middle East, the UK, and the Americas, developing an innovation hub in Hong Kong, and launching a digital management system, OneTeco. The investment will also support new projects in destinations including Abu Dhabi, London, Vancouver, Kenya, Kuala Lumpur, Indonesia, Chongqing, and Osaka, along with the launch of the company’s “Smart Traveller” program in Q3 2024.

MUFG invests in Ascend Money and LanzaJet

Mitsubishi UFJ Financial Group (MUFG) has announced two new investments.

The financial services group is investing USD 195 million in Ascend Money, a leading Thai mobile payments operator affiliated with Charoen Pokphand (CP) Group. This investment, executed through MUFG’s Thai subsidiary, the Bank of Ayudhya (Krungsri), will secure a 10% stake in Ascend Money. MUFG Bank and Ayudhya’s corporate venture capital arm are jointly leading the investment.

The deal will see MUFG appoint an executive to Ascend Money’s management team and explore collaborative opportunities with CP Group. Ascend Money’s TrueMoney service, with around 30 million active users, plans to expand its consumer credit business, leveraging Ayudhya’s expertise in credit decisions and corporate governance systems. This move is part of MUFG’s strategy to enhance its presence in Southeast Asia’s rapidly growing consumer finance market.

In parallel, MUFG Bank has also announced its investment in LanzaJet, a US-based company specializing in sustainable aviation fuel (SAF) production. LanzaJet’s proprietary alcohol-to-jet (ATJ) technology converts ethanol into SAF through a catalytic process, promising significant advancements for large scale SAF production.

Stride secures USD 3 million debt financing from Trine to boost clean energy adoption in Vietnam

Stride, a Ho Chi Minh City-based clean tech company, has secured a USD 3 million debt financing facility from Trine, a Sweden-based solar investment platform.

This funding follows Stride’s earlier USD 2 million seed-stage equity funding from Clime Capital and Touchstone Partners in May 2023, aimed at scaling its business of providing low-cost financing for households as well as small and medium enterprises to implement solar energy projects.

The debt funding will enable Stride to expand its capacity to develop clean energy installations across Vietnam in partnership with local installers. Andrew Fairthorne, CEO of Stride, said that the funds would help accelerate the deployment of solar energy solutions in Vietnam, leveraging the country’s significant renewable energy potential.

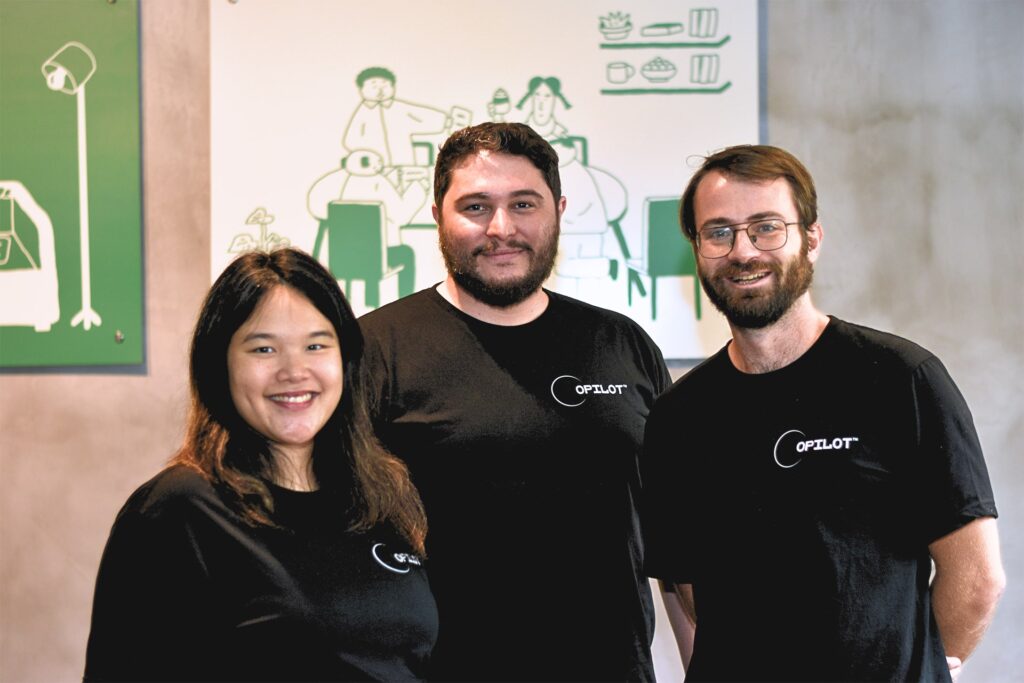

Opilot secures pre-seed funding from Iterative Capital

Opilot, a Singapore-based artificial intelligence startup focusing on data privacy and protection, has raised an undisclosed amount of pre-seed investment from Iterative Capital.

This investment will enable Opilot to scale its premium and enterprise tiers as it begins pilot tests with various companies.

‘Iterative’s backing validates the need to address data privacy as AI adoption increases globally. AI-related data breaches are getting increasingly common, and bad actors are getting access to confidential and personal data. We believe that people should be able to use AI without putting themselves or businesses at risk,” said Julien Lauret, co-founder and CEO of Opilot.

Antler invests in equestrian-focused platform Canterly

Canterly, a startup developing a platform for equestrian businesses, has secured pre-seed funding from early-stage investor Antler, according to an announcement by Nanda Prins, the startup’s founder and CEO.

The company is working on an intelligent operating system designed to tackle manual processes, resource underutilization, and operational inefficiencies in equestrian businesses. In her statement, Prins said Canterly aims to make “equestrian sports universally accessible, creating a vibrant, globally connected community [and] ultimately reimagining how it operates, interacts, and transacts.”

VidAU secures angel funding to enhance AI video creation capabilities

VidAU, an AI-powered video creation platform, has secured angel funding from River Jin Technology to further develop its algorithms and AI models. The financial details of this deal were not disclosed.

In a statement, the company said its platform simplifies the process by enabling users to create videos using lifelike avatars and a suite of video editing features.

D2C brand creator Dachin reportedly secures seed funding

Dachin Etech Global, a Singapore-headquartered D2C brand creator, has secured an undisclosed sum of seed funding from Northstar Ventures, according to regulatory filings accessed by DealStreetAsia.

Recent deals completed in China:

- Jheat Technology, a Shanghai-registered temperature control technology company, has secured an undisclosed amount in an angel funding round from Qingyuan Huaxin Investment. The capital will primarily be used for R&D, enhancing product competitiveness, and market expansion. —36Kr

- AnDiConBio, a developer of drugs designed to counteract respiratory infections, has completed a RMB 200 million (USD 27.5 million) Series A funding round. The round was jointly led by Simcere Pharmaceutical, Huajin Capital, and Huajin Dadao Investment, with follow-on investments from existing shareholders Cowin Capital and Jiaxing Xinchuang Venture Capital, and additional support from Jiaxing Jiarui Future Star Equity Investment, Jinshajiang United Runpu Medical Fund, Wenzhou Capital, Songze Capital, and Shunjie Jiankang. The funds will be used for the preclinical and clinical development of the company’s core product pipeline. —36Kr

- AdvanSol, a developer of micro-string inverters for solar power systems, has completed an extended angel round of financing, led by Edge Ventures. The funds will be used for product development and talent acquisition to further enhance the company’s overall competitiveness. —36Kr

- Zeron, a new energy vehicle company, has secured nearly RMB 100 million (USD 13.7 million) in a Series A1 funding round. The investors include Momenta, Cherish Capital, Skyview Fund, and Guofa Wenxin. The capital will be used for the mass production and delivery of pure electric heavy trucks, R&D of autonomous driving technology, and development of new vehicle models. —36Kr

Atome, Food Empire, Tiger New Energy, and more led yesterday’s headlines:

- Atome Financial, a digital financial technology platform under Advance Intelligence Group, has secured a three-year term debt facility from EvolutionX Debt Capital. The facility includes an accordion feature that could increase the total amount to up to USD 100 million.

- Food Empire Holdings, a Singapore-based multinational food and beverage group, has bagged USD 40 million from private equity fund Ikhlas Capital. The investment will be made into a special purpose vehicle (SPV) wholly owned by the company that will hold or possess the option to hold a portfolio of business operations in Southeast Asia and South Asia.

- Tiger New Energy, a Bangladeshi clean energy startup, has raised an additional USD 1 million in funding from ADB Ventures, augmenting the USD 2.5 million seed round led by Wavemaker Partners in 2023. The investment will accelerate the deployment of Tiger’s battery swapping network across Bangladesh.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].